The Tax Burden on Global Workers – A Comparative Index – First Edition, 2021

Using data calculated by EY, the Institut économique Molinari is issuing its 12th annual study on the real social and fiscal pressure faced by the average wage earner in the European Union (EU).

This ranking has the distinct feature of providing figures for the current year on the social and fiscal pressure faced by the average worker, applying a solid, uniform methodology across all 27 EU member countries. It provides a firm understanding of the real impact of taxes and charges and the changes they are undergoing.

Read the English version (PDF format)

Read the French version (PDF format)

Read the English media release

Read the French media release

An approach that is enhanced by 6 more countries

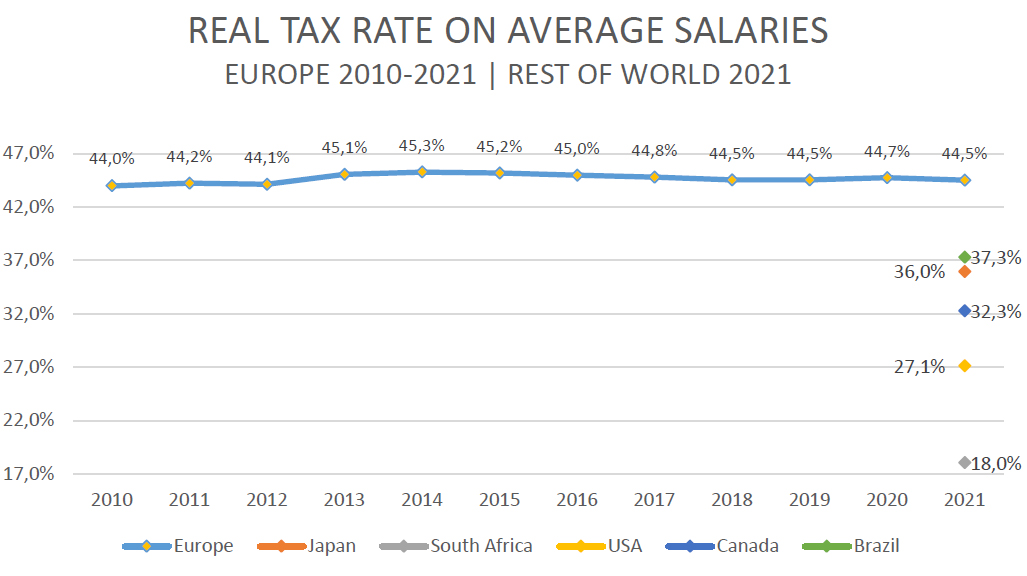

In response to global interest generated by The Tax Burden of Typical Workers in the EU (2010-2020), this year’s 12th edition (2021) is expanding globally – with the inclusion of Australia, Brazil, Canada, Japan, South Africa, and the United States of America – and has been retitled as The Tax Burden on Global Workers. As a group, the 34 countries studied represent 58.2% of the global economy. Our methodology is identical, and we hope to add additional countries in the future.

Abstract

The purpose of this study is to compare the taxes imposed on individual employees earning typical salaries in different countries around the world; and, in doing so, to determine a “tax liberation day” – measuring how many days of each year’s work are devoted to paying taxes – for workers in each of these countries.

Background

Numerous studies rank political systems by various measures of “economic freedom”. While valuable for researchers, the aggregate data in these studies fail to shed light on the role of working individuals in financing their state and social security. Further, many organizations calculate an annual “tax freedom day” for their countries. Unfortunately, inconsistent approaches to this calculation make cross-border comparisons difficult. This study aims to create an “apples to apples” comparison of tax rates, with data that reflect the reality experienced by real, working people around the world. Finally, it serves as a reference to the true cost of hiring employees in each member state and to the real purchasing power of those employees.

Taxes on European workers’ salaries fall to lowest point in a decade; global coverage begins with six added countries

On the whole, incremental policy changes and pandemic relief measures have brought mild tax relief to European workers this year, as the average “real tax rate” for typical workers in Europe (now defined as the EU countries plus the United Kingdom) ticked down 0.2% this year to 44.5% – however this relief was not felt consistently across the continent: 2021’s tax liberation days arrive earlier in 10 European countries, later in 8, and on the same day in 10.

The chart below shows the progression in Europe since 2010, with single data points for the six new countries added to our research: Australia, Brazil, Canada, Japan, South Africa, and the United States (USA).

The podium: Austria makes its debut, tied with France, as the “world champion” of taxation

Workers in France and Austria are the highest-taxed – not only in the European Union but among the full group of 34 global countries studied – and they celebrate their tax liberation day on July 19th.

Belgium holds its third-place position for the fourth consecutive year, and its workers celebrate once again on July 15th. For several years Europe’s least friendly tax environment for employment (its tax liberation day in 2013 was August 8th), relief was brought by the Michel government’s “tax shift” (2016-18), and additional cuts are being proposed for 2024.

Greek rebound continues

Payroll tax cuts implemented by the Mitsotakis government, elected in 2019, continue to benefit Greek workers, whose tax liberation day has quickly moved forward in the calendar: from July 10th in 2019 to June 22nd last year, now to June 14th in 2021.

The Greek economy has reason to celebrate, as well: Despite the pandemic, which led to higher unemployment rates worldwide and acutely impacted the tourism industry, Greece’s unemployment rate has been falling since the tax cuts came into effect.

Czech workers celebrate two weeks earlier

From 2008-20, the Czech government levied income tax on employees for the health and social insurance paid by their employers, often pushing them into a higher tax bracket. New legislation made effective January 1st of 2021 eliminated this double taxation and reduced the effective real tax rate for Czech workers by nearly 4%.

The prevalence of “hidden” tax contributions continues

For every €100 of payroll taxes collected by governments, €40 euros is paid “on top” of gross salaries as employer contributions to social security. In many countries, these levies do not appear on workers’ payslips.

tax_burden_on_global_workers2021