France and Austria top the list in taxation of the average worker in 2021 in a European Union that is resisting the temptation to raise taxes to cover deficits

Paris, July 19, 2021 – Using data calculated by EY, the Institut économique Molinari is issuing its 12th annual study on the real social and fiscal pressure faced by the average wage earner in the European Union (EU).

This ranking has the distinct feature of providing figures for the current year on the social and fiscal pressure faced by the average worker, applying a solid, uniform methodology across all 27 EU member countries. It provides a firm understanding of the real impact of taxes and charges and the changes they are undergoing.

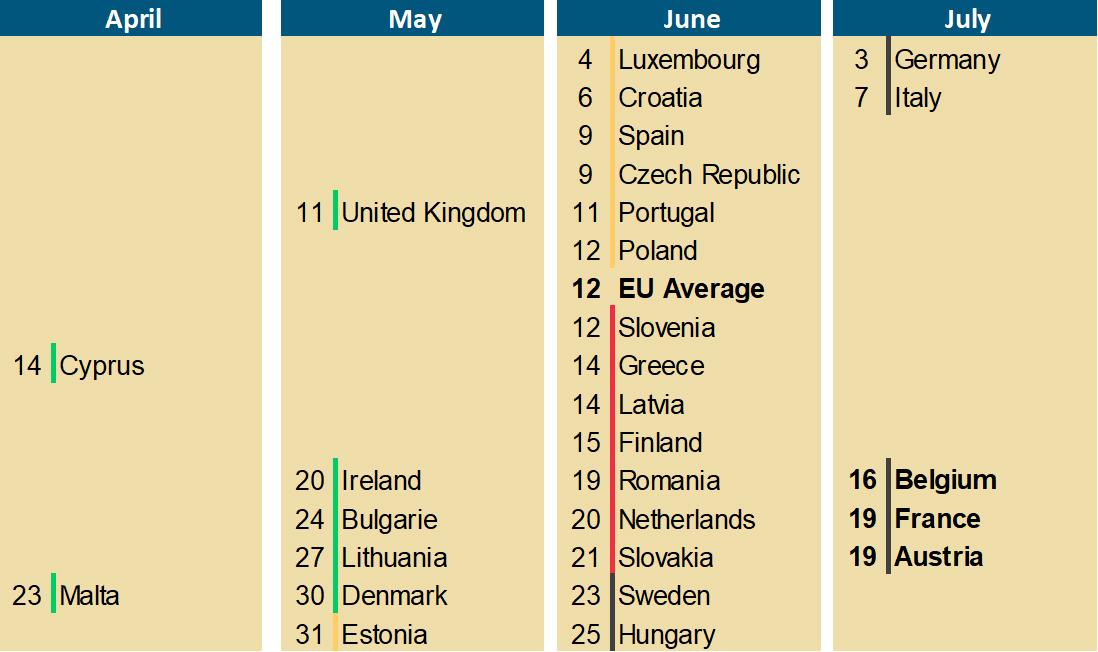

2021 TAX AND SOCIAL CHARGE FREEDOM DAYS FOR THE AVERAGE WORKER

Source: Institut économique Molinari, data provided by EY

Source: Institut économique Molinari, data provided by EY

WHAT THE 2021 NUMBERS TELL US ABOUT EUROPE

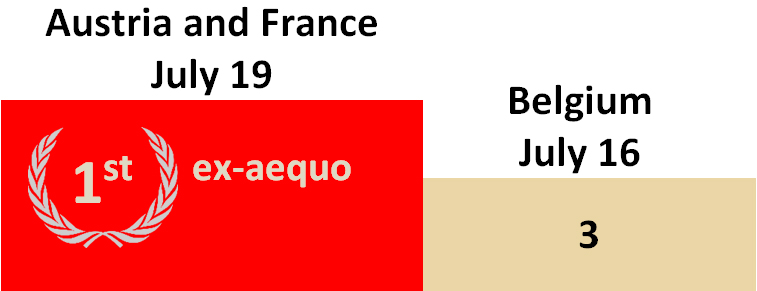

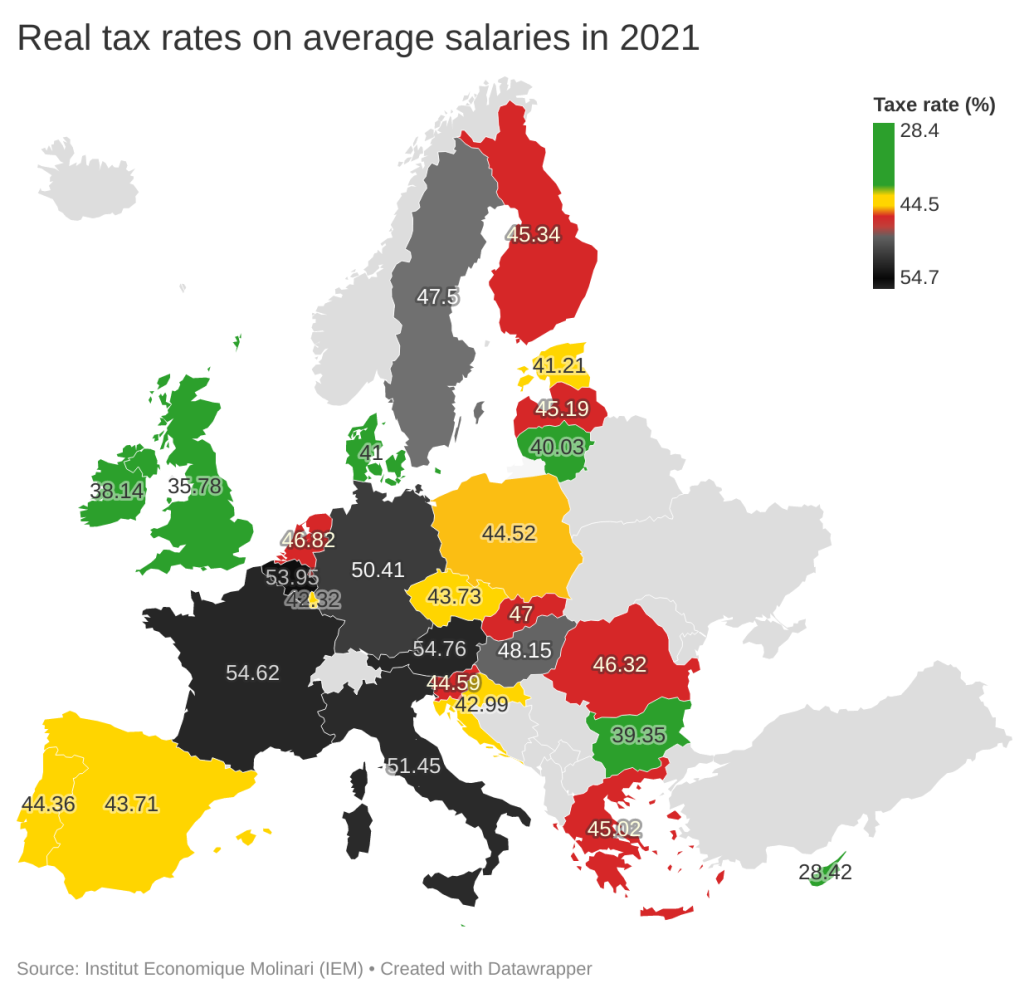

As has been the case since 2012, the three European Union countries that top the list in taxation of the average worker are Austria, France and Belgium.

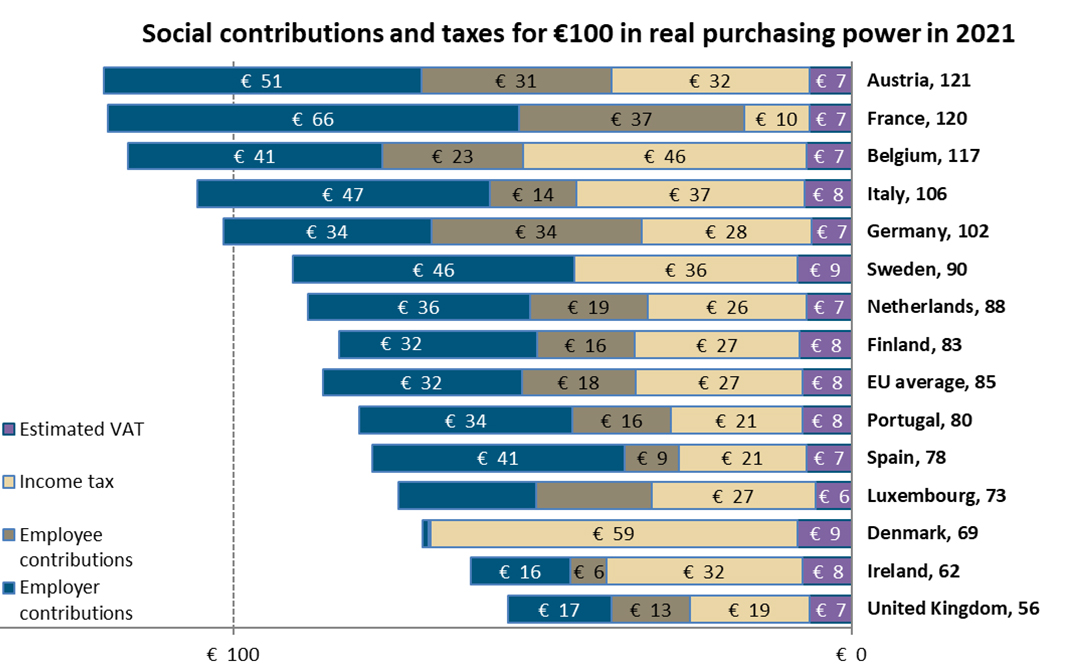

Before having €100 in real purchasing power, the average worker must cover €117 in social charges and taxes in Belgium, compared to €120 in France and €121 in Austria. The EU average is €85.

Source: Institut économique Molinari, data provided by EY

In 2021, Belgium remains third on the podium, but now France and Austria are tied for first place, with both countries marking tax freedom day on July 19.

In Belgium, tax and social charge freedom arrives on July 16, the same day as in 2020. The former number one in this ranking (from 2011 to 2015) moved into the number-two spot (in 2016 and 2017) thanks to its “tax shift” and then into third place starting in 2018. It remains there in 2021, with 53.95% social charge and tax pressure on the average worker, up slightly from last year (+0.19%) following a rise in the average wage, which caused a disproportionate increase in the income tax burden.

In France, tax and social charge freedom falls on July 19, as in 2019 and 2020. The tax burden on the average worker amounts to 54.62%, down very slightly from last year (-0.06%) due to wage stagnation.

In Austria, tax and social charge freedom comes on July 19, one day later than in 2020. The burden on the average worker amounts to 54.76%, up slightly from last year (+0.30%) following a rise in the average wage, which caused a disproportionate increase in the income tax burden.

In five countries, more than half of work-related income is collected in taxes and social charges: Austria, France, Belgium, Italy and Germany. Average workers in those countries have no direct control over more than 50% of the fruits of their labour, with their influence over decision-making being indirect at best.

Over the last year, 14 countries in the 27-member EU have experienced an increase in compulsory levies. In 10 of these countries, changes in compulsory levies are leading to the loss of at least one day of purchasing power: Malta (four fewer days), Estonia and Ireland (three days), Finland (two days) and Austria, Cyprus, Spain, Luxembourg, Slovakia and Slovenia (one fewer day).

At the same time, 13 EU countries saw a decline or stability in levies. Eight of these countries recovered at least one day of purchasing power: Germany, Italy and the Netherlands (one day), Latvia (two days), Hungary (three days), Croatia (five days), Greece (eight days) and Czechia (14 days).

The improvement in Greece continues, with an eight-day gain in purchasing power this year:

- Cuts in social charges enacted by the government of Kyriakos Mitsotakis, elected in July 2019, continue to benefit Greek workers, whose tax and social charge freedom day has moved briskly to earlier in the calendar, from July 10, 2019, to June 22, 2020, to June 14, 2021.

- The Greek economy has provided other reasons for celebration. Despite the pandemic, which has led to higher unemployment worldwide and which hit the tourism sector hard, Greece’s unemployment rate has fallen since the tax cuts took effect.

Czech workers celebrated their tax and social charge freedom 14 days earlier:

- From 2008 to 2020, the Czech government had increased the income tax yield on workers by including employer contributions in the calculation of the taxable base, leading to double taxation.

- New legislation that took effect on January 1, 2021, has eliminated this double taxation. It reduces the effective real tax rate on the average worker by 3.8 points, to 43.7% in 2021 from 47.5% in 2020.

On average, tax and social charge freedom comes on June 12 in the European Union, one day earlier than in 2020. All told, the various European governments have resisted the temptation to raise taxes in order to cover the deficits caused by the pandemic.

- In 2021, the real tax rate on workers is 44.51% in the EU 27, down 0.15% compared to 2020 and down 1.10% from the peak in 2014.

- Average workers generating €100 in income before social charges and taxes are having to pay €44.51 in compulsory levies in 2021. This means they will have €55.49 in real purchasing power at their disposal, which is €0.15 more than in 2020 and €1.10 more than in 2014.

WHAT THE 2021 NUMBERS TELL US ABOUT FRANCE

Constraints in purchasing power

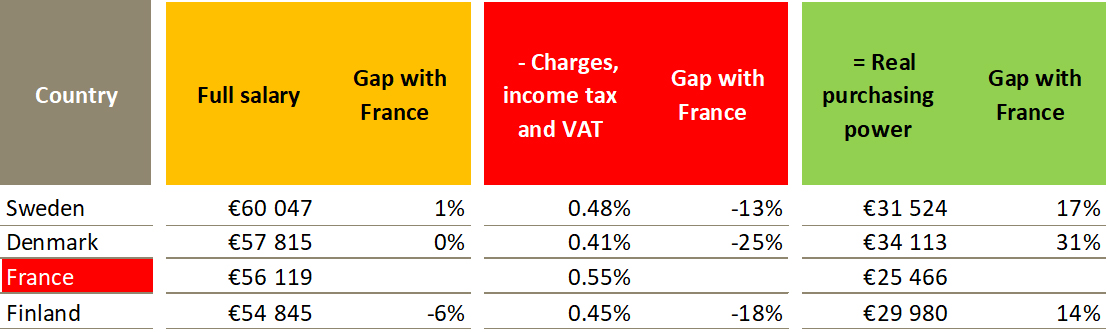

- Average workers in France remain among the best paid in theory, at €56,119 (ranking eighth in the EU, between Denmark and Finland), but their labour is so heavily taxed (54.62% in social charges and taxes on their full salary) that they are left with only €25,466 in real purchasing power (ranking 11th in the EU, between Belgium and Spain).

- While they cost as much to their employers as Danish or Finnish workers, average French workers have 18% less purchasing power than the former and 34% less than the latter.

- While their employers face labour costs similar to those prevailing in the EU’s northern countries, the average worker’s purchasing power is midway between levels in the northern and southern countries.

Source: Institut économique Molinari, data provided by EY

Record social charges

- This social charge and tax pressure is due above all to employers’ charges (55%), employees’ charges (30%) and, to a lesser extent, income tax (9%) and VAT (6%).

- In France, social charges alone (€26,229, the highest in the EU) are higher than real purchasing power (€25 466, ranking 11th in the EU). They amount to 103% of purchasing power. This is the record among countries in the EU 27, where the average is 51%.

Higher social charges and taxes do not mean greater well-being

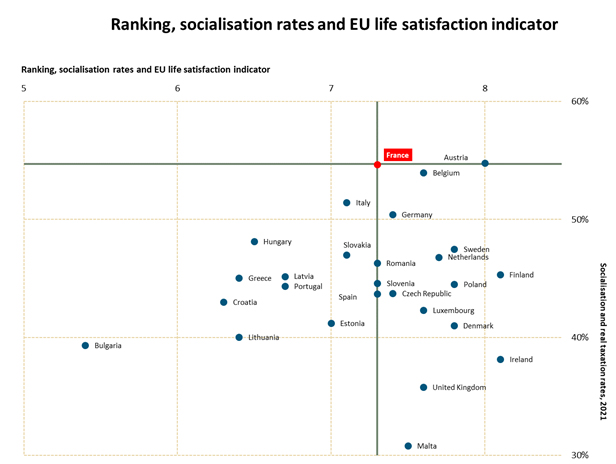

- The study demonstrates that social charge and tax pressure is not synonymous with living better.

- The EU life satisfaction indicator shows an average performance in France, where the satisfaction level matches the European average (7.3 out of 10). Within the EU, France ranked 13th out of 27 countries (or 14th out of 28 if the United Kingdom is included).

- Life satisfaction is greater in several countries with lower social charge and tax pressure. This is true of continental countries (Germany, Belgium, Luxembourg, Netherlands, Poland, Czechia), Beveridgean countries (Ireland, Malta, United Kingdom) and northern countries (Denmark, Finland, Sweden).

Higher social charges and taxes do not mean better public services

- The study shows that French social charge and tax pressure cannot be explained by a more attractive offering of public services. French social and public benefits are far from inexpensive, as recent work by the Institut économique Molinari illustrates.

- Pensions, which account for 27% of public spending, are financed almost exclusively on a pay-as-you-go basis. They provide a lower return than in countries where contributions are supplemented by savings, with France forgoing about €60 billion a year in share dividends, bond coupons and capital gains. This automatically erodes the value for money of French pensions, with an annual shortfall amounting to €3,750 per pensioner, or one-fifth of the pensions distributed.

- Value for money is also average in education, which accounts for 10% of public spending. A decline can be observed in French rankings, despite substantial collective investment. Although France spends €155 billion a year on education, it ranks only 17th among 27 European countries. If France were to move closer to the most efficient countries in matching education with the job market, it could save up to €43 billion a year.

QUOTES

Nicolas Marques, general manager of the Institut économique Molinari, co-author

“Despite the changes in social charges and income tax over the last few years, average workers in French remain the most heavily taxed in Europe, along with the Austrians.

“Over the years, we have become the tax and social charge champions. The result has been lower growth in France than in the rest of the European Union, and structural unemployment remains abnormally high. Our public deficits fall at a slower pace than elsewhere during upturns, and debt rises more during downturns.

“In the absence of significant growth, measures intended to restore middle-class purchasing power often look too much like to-and-fro games. The year 2019 was marked by a decrease in social charges, but unfortunately the effect was offset by an increase in the generalised social contribution. The year 2020 saw a decrease in income tax, with the lowest bracket reduced to 11% from 14%, but with the threshold for entering this bracket lowered to 30%, the financial gain for the average worker was reduced.

“Restoring workers’ purchasing power requires the courage to confront structural issues with systemic reforms.

“There is a need to diversify the financing of pensions, which relies almost exclusively on compulsory levies that hinder competitiveness and employment. Among our neighbours, a significant portion of pension costs is financed by capitalisation, making pension financing less costly for the economy and providing better value for money for pensioners and for the working population.

“There is also the challenge of reducing forms of taxation that penalise job creation and wage growth. A significant portion of outsized French production taxes and of corporate taxes are borne by workers. These taxes hold back wage growth in France and encourage offshoring. These are societal errors.”

Cécile Philippe, president of the Institut économique Molinari and co-author

“The absence of a direct link between the quality of public services and the tax and social charge burden makes one of the reasons for France’s economic decline more visible. With the wealth we have accumulated over the decades, we are now confusing causes and effects. All too often, we think wealth simply has to be thrown at a problem for the problem to be resolved, whereas money is the result of a wise investment that has produced tangible results. Today we hold the mistaken belief that levies and deficits merely have to be aligned to produce the results we expect. We have forgotten that it takes a strategy and a tactical approach to achieve effective deployment.

“Investing wisely requires having a vision and checking the actual returns. But we have lost the habit of checking to see whether our taxes and our deficits are legitimate. The time has come to convert our expenditures into investments, whether for pensions, health care, education or housing.”

James Rogers, associate researcher at the Institut économique Molinari, co-author

“Despite the good news, French and Belgian wage earners are still devoting more than half of the amounts distributed by their employers to social contributions and taxes.

“It’s worth asking why they are not getting the top schools, the best health care and the most generous pensions in return and why they are not the leaders in indicators of human development or well-being.”

DATAWRAPPER

https://www.datawrapper.de/_/uB2h9/

ABOUT THE AUTHORS AND THE METHOD

Tax and social charge Freedom Day is the date when the average employee stops, in theory, paying social charges and taxes and can use the fruit of her labour as she pleases.

This indicator measures the date starting on which the employee becomes free to apply the fruits of her labour in the way she wishes and not the date starting on which the employee may stop “working for society.”

The particularity of this indicator of economic freedom is that it puts the situation of average EU wage earners in tangible form by bringing together each country’s taxation of labour (social charges and income tax) and of consumption (VAT). Calculations of employer and employee social charges and of income taxes are done by EY for each of the 28 EU countries.

The study is written by Cécile Philippe, Nicolas Marques and James Rogers of the Institut économique Molinari (IEM).

The Institut économique Molinari (Paris and Brussels) is an independent research and education organisation. It seeks to stimulate the economic approach in the analysis of public policy, offering innovative alternative solutions that favour the prosperity of all individuals making up society.

THE STUDY IS AVAILABLE IN

- French at: https://www.institutmolinari.org/2021/07/18/la-pression-sociale-et-fiscale-reelle-du-salarie-moyen-au-sein-de-lue-en-2021/

- English at: https://www.institutmolinari.org/2021/07/18/the-tax-burden-on-global-workers-a-comparative-index-first-edition-2021/

FOR INFORMATION OR INTERVIEWS, PLEASE CONTACT

- Cécile Philippe, president of the Institut économique Molinari (French or English),

cecile@institutmolinari.org, +33 6 78 86 98 58 - Nicolas Marques, general manager of the Institut économique Molinari (Paris, French),

nicolas@institutmolinari.org, +33 6 64 94 80 61 - James Rogers, associate researcher at the Institut économique Molinari (Brussels, English),

james@institutmolinari.org, +32 497 946 840