The Tax Burden of Typical Workers in the EU 28 – 2019

The purpose of this study is to compare the tax and social security burdens of individual employees earning typical salaries in each of the 28 member states of the European Union.

——————————————–

Read the study in PDF format

Read the Press release

——————————————–

Abstract

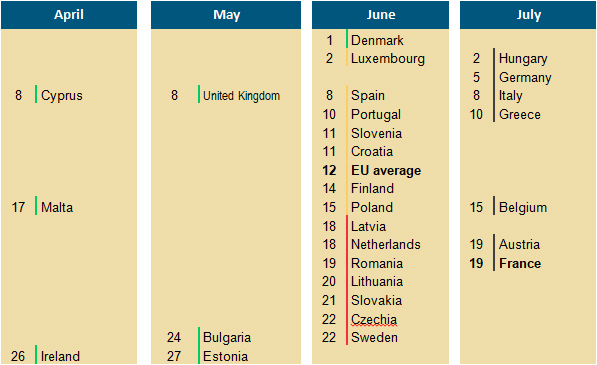

The purpose of this study is to compare the tax and social security burdens of individual employees earning typical salaries in each of the 28 member states of the European Union and, in doing so, to determine a “tax liberation day” – measuring how much of each year’s work is devoted to paying taxes – for workers in each country.

In addition, the study tracks year-to-year trends in the total cost, including taxation, of hiring salaried employees in the EU-28.

Background

Numerous studies rank political systems by various measures of “economic freedom”. While valuable to economists, the aggregate data in these studies fail to shed light on the working individual’s role in financing their state and social security.

In addition, many organizations determine an annual “tax freedom day” for their countries. Unfortunately, conflicting approaches to this calculation make cross-border comparisons difficult.

This study aims to create an “apples to apples” comparison of tax rates, with data that reflect the reality experienced by real, working people in the European Union. Finally, it serves as a guide to the true cost of hiring employees in each member state.

2019 TAX AND SOCIAL CONTRIBUTION FREEDOM DAYS FOR THE AVERAGE EMPLOYEE