Better, but not quite “Swedish” – Belgian workers celebrate Tax Liberation Day – “Tax Shift” passes yello jersey to France

Media release

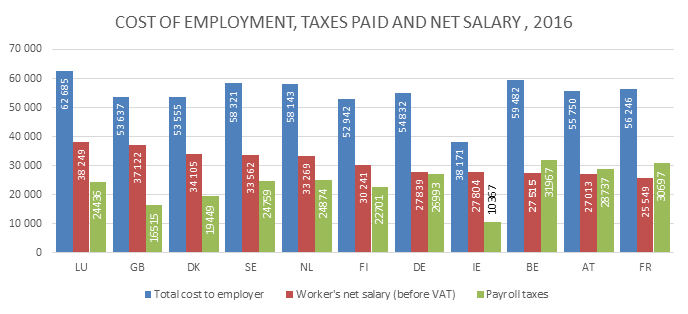

Brussels, 27 July 2016 – The “tax shift” enacted by Charles Michel’s government in Belgium has reduced the real tax rate for Belgian workers from 59.47% to 56.9%, accelerating the arrival of Belgian workers’ Tax Liberation Day by nine days to today. After five consecutive years as the country with the highest-taxed employees in Europe, Belgium cedes that distinction to France, where the Tax Liberation Day of July 29th is unchanged from last year.

Using a consistent methodology across all countries, the data reflect the tax realities experienced by real, working people. 2016’s Tax Liberation Days are as follows:

Key findings – Belgium

• Belgium is now the country that taxes labour at the second-highest rate in the European Union; an employer in Belgium spends 2.16€ for a typical worker to net 1€ after taxes (not including VAT on the net pay spent). The 2015 figure was 2.30€.

• In real terms, more tax euros are collected on a Belgian employees’ salary (31 967€) than in any other EU country.

• Belgians are now the second-most expensive employees to hire in the EU, but rank 9th in net income.

• A Belgian employee’s “real tax rate” (including VAT) is now 56.9%, compared to an EU average of 45.0%.

Key findings – Europe:

• As a single economic entity, typical workers across the European Union saw their average “real tax rate” dip slightly this year, from 45.2% to 45.0%. Since 2010, this figure has risen by 1.0%, due mostly to VAT increases in 20 of the 28 states.

• 44.4% of all payroll taxes collected in the EU countries – employer contributions to social security paid on top of gross salaries – are largely invisible to employees.

• In countries with “flat tax” policies, typical workers, continue to be taxed at higher rates in « flat tax » countries (45.7%) than in « progressive » systems (44.8%) – a gap that has persisted since 2010.

• More than half (54.9%) of EU citizens are not in the labour force – a figure that is worsening as Europe’s population grows older: Since 2010, the proportion of Europeans outside the labour force has grown by 1 %.

Quotes from co-author James Rogers:

“The tax shift enacted by our “Swedish” government is a step in the right direction, but Belgians are still working five weeks longer than actual Swedes do to pay their taxes.” Belgium’s highly productive workers are still Europe’s second-most-expensive to hire, and overall, their salaries pay more euros into the treasury than in any other country.”

“Belgian workers pay more for their government than any other Europeans. It’s worth asking why they are not getting the best schools, the best health care, and the best pensions in return.”

Quote from co-author Cécile Phillipe:

“Much still need to be done in Belgium but the current government has demonstrated its capacity to reverse the trend of the average Belgian employee. France is now last in our study. This is to be its turn to show the capacity to reform when the cost/quality ratio of French public expenditures is poor in comparison with other countries that have a similar social tradition.”

“Tax Liberation Day” is the calendar day on which a worker theoretically stops working to pay taxes to the state and begins to keep his/her earnings. The data in the calendar reflect the reality experienced by real, working people in the European Union and the true cost of hiring employees in each state.

The study, by James Rogers and Cécile Philippe of Institut économique Molinari, uses OECD and national statistics office salary figures for as a baseline. Payroll tax calculations are made by EY.

The 2015 study is available from the following links: https://www.institutmolinari.org/the-tax-burden-of-typical-workers,2622.html

Note to editors: The Institut économique Molinari (IEM) is an independent, non-profit research and educational organization. Its mission is to promote an economic approach to the study of public policy issues by offering innovative solutions that foster prosperity for all.

For more information please contact the authors of the study:

James Rogers

Research Fellow-Institut économique Molinari

james@institutmolinari.org

+ 32 497 946 840

Cécile Philippe

Director – Institut économique Molinari

cecile@institutmolinari.org

+33 678 869 858