In Search of Lost Purchasing Power – When Public Policies Harm Purchasing Power

The Institut économique Molinari publishes a study dissecting structural factors fueling tensions around purchasing power in France. It analyses four families of regulations reducing the purchasing power of households by at least 4,300 euros per year. It proposes structural reforms that would enable a response to the legitimate concerns of households, by freeing up their purchasing power, by improving the quality/price ratio of their individual and collective consumption.

Read the study • Read the press release • Lire l’étude • Lire le communiqué

In these times of instability, with a global pandemic and the return of war to the edges of Europe, concerns about purchasing power are particularly important.

While it was known that wage growth had become modest in developed countries, this effect was until recently offset by access to relatively cheap foreign products. Both the pandemic and the Ukrainian conflict continue to cause a reorganization of commodity flows, particularly energy, and a rise in the price of a number of products. Concerns about purchasing power and inflation have become more prominent.

In keeping with the tradition of the Institut économique Molinari, we have sought to make an indepth analysis by integrating various structural factors that explain, at least in part, the structural tensions surrounding purchasing power.

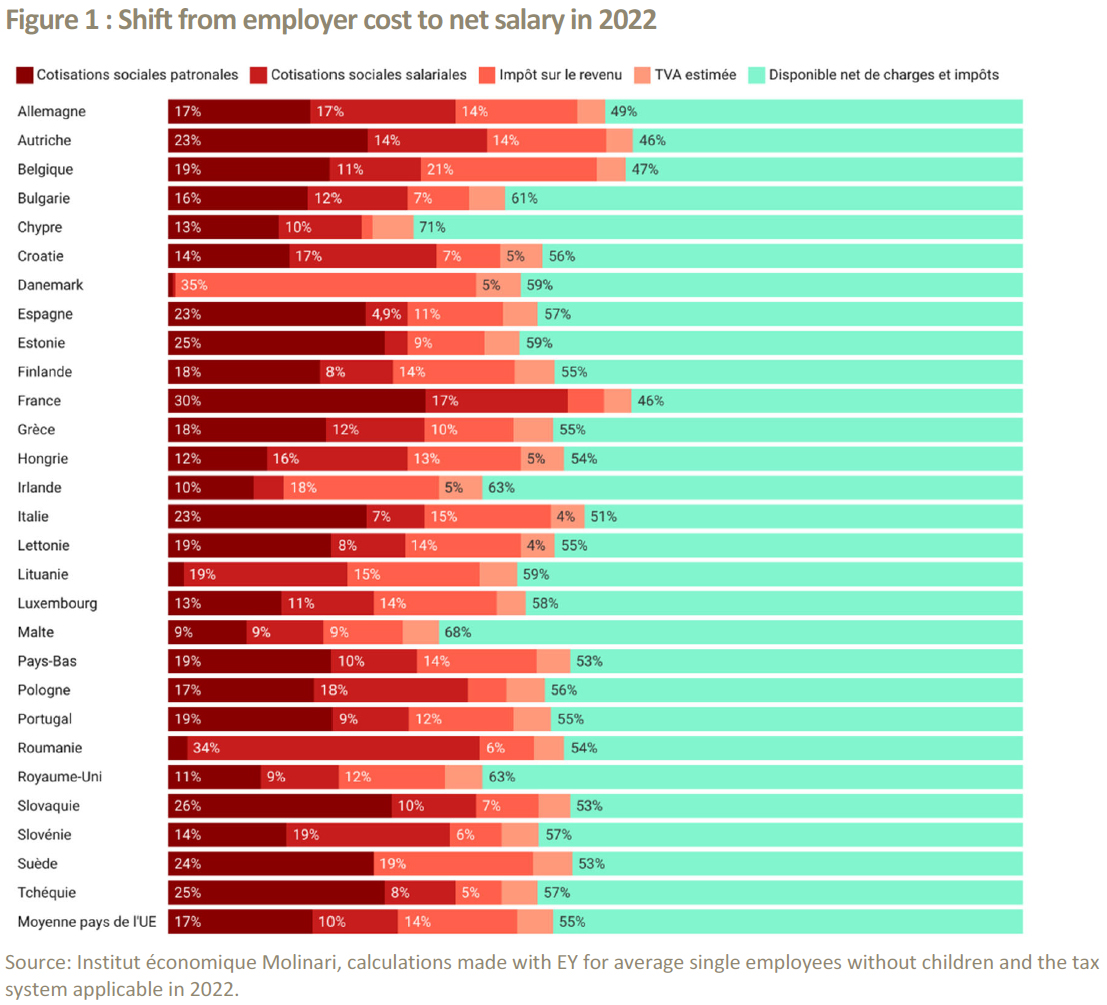

Every year since 2010, we have published a European ranking of countries according to the real social and fiscal pressure on the average employee. The taxes measured include employer and employee contributions to mandatory public and private law schemes (mutual insurance, pension funds, etc.), income tax and VAT. In France, the tax burden on the average employee is 54% (Figure 1). The average employee is particularly well paid with 54,600 euros before contributions and taxes, but his work is so taxed that he is left with only 25,000 euros net.

In fact, a whole series of regulations increase the burden on employees beyond what this analysis shows, taking into account social contributions, income tax and VAT. Specific taxes or regulations have an impact – direct or indirect – on purchasing power. We thought it would be interesting to measure the extent of this impact in order to better understand the current tensions.

Specific regulations increase the price of housing, which is now the number one item of household expenditure (chapter 1). Special taxes increase the price of certain goods, notably fuel and tobacco (chapter 3). At the same time, a particularly high tax burden on economic activities increases the cost of labour and undermines wealth creation and wage dynamism (chapter 3), while the lack of diversification of pensions increases the cost of financing pensions, which puts a strain on the takehome pay of both working people and pensioners (chapter 4).

The structural reforms proposed in this work would make it possible to respond, at least in part, to the legitimate concerns of the French about their purchasing power by freeing it up without harming the community as a whole.

study-lost-purchase-power-en