Reducing French production taxes by €35 billion would add €42 billion in personal income and create 750,000 jobs without increasing public deficits

Paris, November 15, 2021 – The Institut économique Molinari has issued a ground-breaking study on how businesses, households and public finances would benefit by lowering French production taxes to the levels prevailing in other European Union countries.

The study concludes that France must dare to boost its economy through a drastic reduction in these anti-production levies and reverse existing negative trends by turning to the country’s productive forces.

TAXES OR JOBS

- A €35-billion cut in production taxes is needed to harmonise French taxes at the European level on top of the reduction the government outlined in its recovery plan, limited to €10 billion.

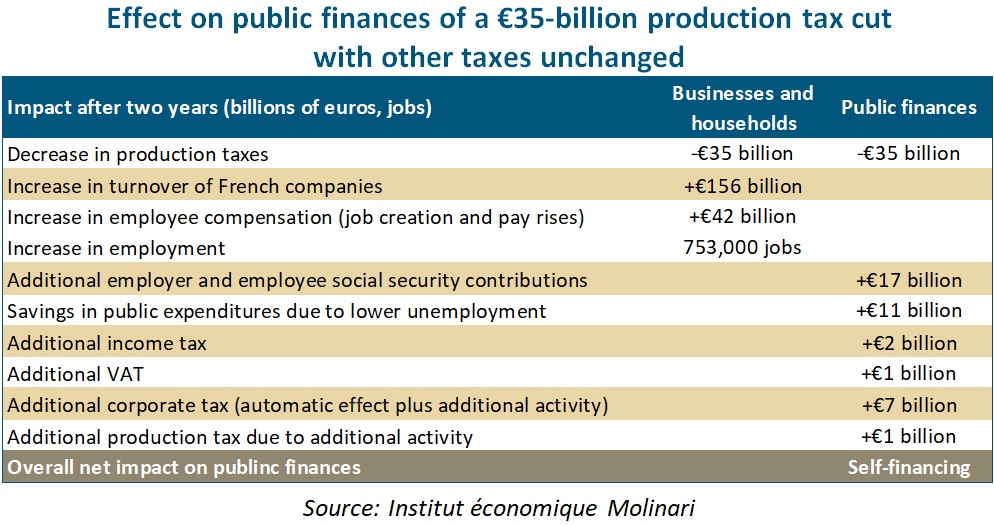

- This reduction would generate huge win-win ripple effects, adding €156 billion in turnover, €42 billion in wages and salaries and €12 billion in net surpluses, at zero cost to the public finances after two years.

- The big winners would be members of the workforce, whether employed or unemployed, with €25 billion in additional net wages and 750,000 jobs created.

Aligning French production taxes with the European average would provide for the distribution of €25 billion in additional net wages after the deduction of social security contributions and would lead to the creation of 750,000 jobs. France would absorb a significant portion of its excess unemployment, evaluated at 1.3 million compared to Germany at the end of September.

TAX MEASURES THAT BRING IN AS MUCH AS THEY COST

- The drop in production taxes would be offset after two years by the decline in unemployment-related spending (€11 billion) and by increases in social security contributions (+€17 billion), corporate tax (+€7 billion), personal income tax (+€2 billion) and VAT (+€1 billion).

- Production taxes can be harmonised downwards without raising other taxes or adding to public deficits. “Downstream” taxes offset two-thirds of the shortfall with no need to increase current tax rates. Cuts in public spending resulting from lower unemployment would offset the rest.

AN ISSUE FOR THE ECONOMY AND FOR BUSINESS SECTORS

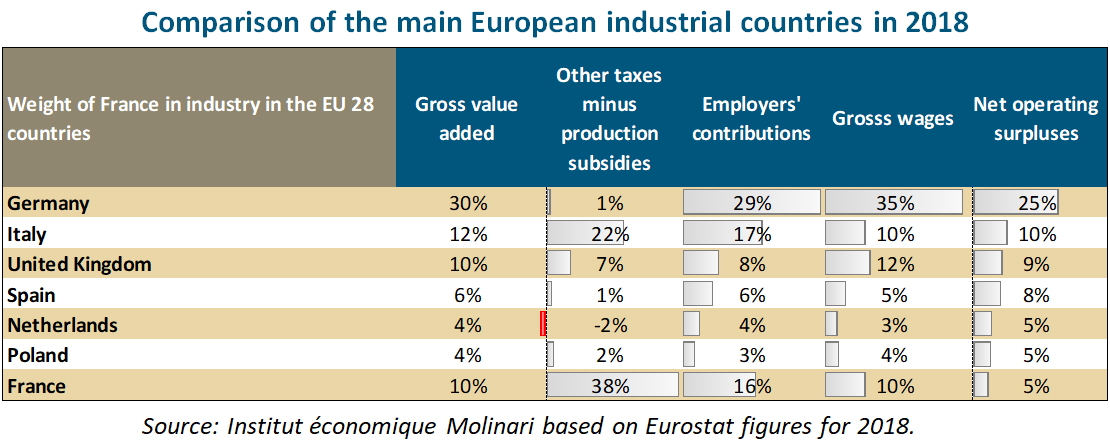

- Comparisons show that the French economy suffers from a production tax level that bears no relation to its creation of added value.

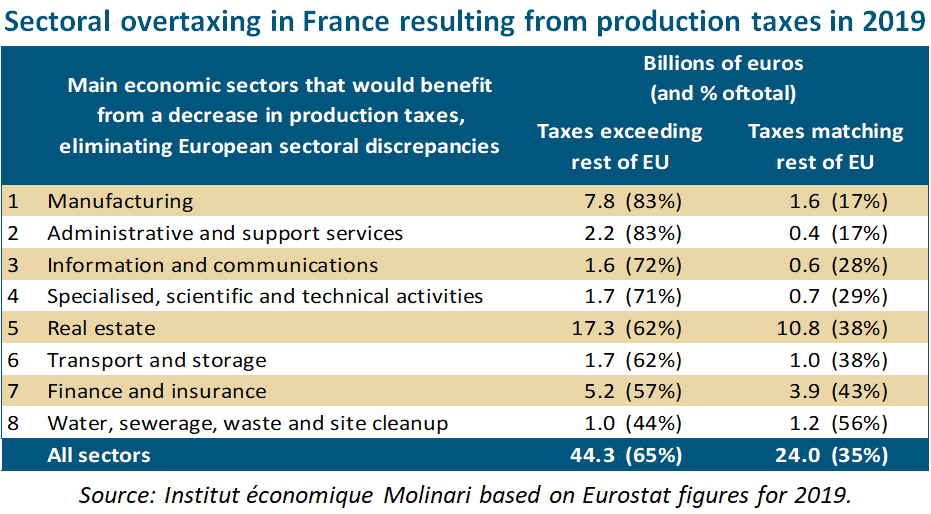

- In 2019, France accounted for 33% of net production taxes in the 28-member European Union but created only 15% of added value.

- Three-quarters of production taxes would have to be eliminated in communications, administrative and support services, transport and storage to match the European level. In industry, production taxes would have to be cut even further, by four-fifths.

- French industry is penalised by production taxes amounting to 38% of the EU total, whereas it accounted for only 10% of added value in 2018. Production taxes and, to a lesser extent, employers’ social security contributions, are what explain its lack of competitiveness. Gross wages are not at issue.

AN ISSUE FOR WAGE-EARNERS AND THE UNEMPLOYED WHO BEAR THIS TAX BURDEN

- Production taxes, which bear no relation to companies’ health or financial performance, present a danger to the survival of low-margin businesses and jobs in France, as shown by the closing of the Bridgestone tire factory in Béthune. With €7 million in production taxes in 2018, this business could not be profitable in France. It was generating €5 million in losses, caused by the harshness of French taxation. Similarly, other industrial sites are under threat (Alcatel-Lucent, Jacob-Delafon, Michelin, Schneider Electric, Verallia) due to lack of competitiveness.

- Maintaining this form of taxation, which was supposed to be eliminated with the advent of the VAT in the 1950s and 1960s, is doubly nonsensical. It encourages job destruction in traditional low-margin sectors that are exposed to competition. And it deters job creation in the areas of the future.

- Tax incidence shows that the cost of production taxes is ultimately passed on to wage-earners and the unemployed.

The cost of taxation on companies is passed on to households in proportions that depend on the respective power of consumers, employees or shareholders. In areas exposed to significant competition, the tax incidence does not fall heavily on consumers, who have access to more competitive foreign products. It falls more heavily on shareholders and employees, with varying timeframes. Shareholders, who are less mobile in the short term, are forced initially to assume a significant portion of production taxes. But they can reduce their investments in the medium term or even pull out of countries with excessive taxes. Members of the workforce, whether employed or unemployed, are the least mobile. They are the ones who bear the brunt of production taxes in the form of lower wages and lower job numbers.

AN ISSUE FOR LOCAL AUTHORITIES

- Public finances would not be destabilised by cuts in production taxes. However, it will be necessary to offset the shortfall suffered by local authorities, which receive the bulk of production taxes (66%), accounting for 28% of their funding.

- The most promising solution is the sharing of traditional forms of taxation, as is done in many countries with consumption taxes (Canada, Spain, United States), income tax (Denmark, Finland, Iceland, Norway, Sweden) or corporate tax (Germany).

QUOTES

Pierre Bentata, co-author of the study

“Our European simulations confirm recent work by the Conseil d’analyse économique, Asterès and Rexecode emphasizing the counterproductive nature of French production taxes, which in effect are taxes against production and employment.

“Our analysis shows that production taxes would have to be cut in half to be aligned with those of our neighbours and that this would not destabilise our public finances. Lowering production taxes would lead to the creation of 750,000 jobs, savings of €11 billion in unemployment-related spending and €42 billion in additional wages and salaries, generating in turn an increase in revenues from traditional forms of taxation. This common-sense measure would be self-financing since taxes would be collected downstream instead of upstream where they have a disincentive effect.”

Nicolas Marques, Managing Director of the Institut économique Molinari (IEM) and co-author of the study

“It is not a matter of choosing between production taxes and deficits. Rather, it comes down to getting rid of taxes that kill production and employment in France, and instead relying solely on taxes that are compatible with wealth creation that benefits the greatest number.

“By maintaining outsized production taxes over the last few decades, France has, in retrospect, committed an error. It has suppressed economic activity and employment, thereby amplifying imbalances in public finances rather than helping reduce them. To be aligned with our European neighbours, we would need to lower this taxation by €35 billion per year in addition to the €10-billion reduction already in effect,”

Cécile Philippe, President of the Institut économique Molinari (IEM)

“France is going against basic teachings of economics and taxation, such as avoiding taxation on the factors of production that put a squeeze on low-margin businesses and make wealth creation more difficult. The country should rely instead on value-added and income taxes that harness players in due proportion to their resources and that adjust to the changes they experience.

“Our excessive taxation of the factors of production drives production and employment out of France. The financial resources this provides in the short term come at a high cost. In the long term, our production taxes destroy our ability to create collective wealth. They deter the development of the economic fabric, hinder wage increases and fuel unemployment. Dismantling them should be a national multi-partisan issue. It is a priority to empower the unemployed, wage earners and consumers.”

RESOURCES

The study, titled “Production taxes hold back wages, jobs and growth”, is available on our website.

FOR INFORMATION OR INTERVIEWS, CONTACT

Nicolas Marques, Managing Director, Institut économique Molinari

(Paris, in French)

nicolas@institutmolinari.org

+33 6 64 94 80 61

Or Cécile Philippe, President, Institut économique Molinari

(Paris, Brussels, in French or English)

cecile@institutmolinari.org

+33 6 78 86 98 58

ABOUT THE IEM

The Institut économique Molinari (IEM) is a research and education organisation with the mission of promoting individual freedom and responsibility. The Institute aims to facilitate change by spurring debate around preconceived ideas that engender the status quo. It seeks to stimulate the emergence of new consensus positions by offering an economic analysis of public policy, demonstrating the value of dialogue and indicating the benefits of more lenient regulation and taxation. The IEM is a non-profit organisation financed by voluntary contributions from its members: individuals, foundations and businesses. Putting intellectual independence foremost, it accepts no public subsidies.