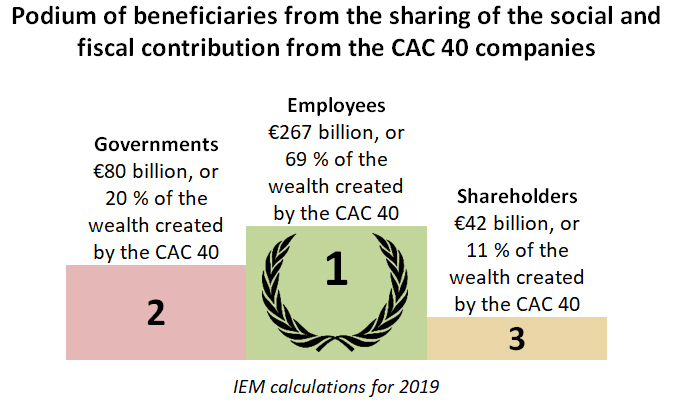

The wealth created by CAC 40 companies totalled €389 billion in 2019. The greatest beneficiaries were employees, followed by governments and then shareholders.

Paris, June 10, 2020 – The Institut économique Molinari has released a new study on the social and fiscal contribution of the CAC 40 companies. It presents a new way of quantifying the wealth created by these companies, outlining the sharing of this wealth between employees, governments and shareholders.

It shows that the CAC 40 companies created €389 billion in wealth for the French and global community in 2019.

This social and fiscal contribution:

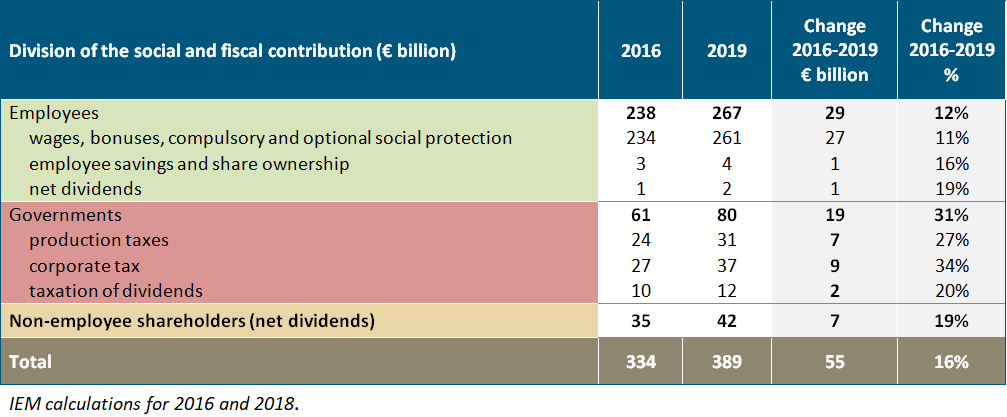

- primarily benefited the CAC 40 companies’ 5.1 million employees, with €267 billion in payroll spending, followed by governments, with €80 billion in tax payments, and then shareholders, with €42 billion in after-tax dividends;

- grew by 16% in three years, with governments the big winners, capturing an additional 31% due to the dynamism of the corporate income tax (+34%) and production taxes (+27%).

If we focus solely on the division of distributed earnings, amounting to €97 billion, we see that:

- governments are the primary beneficiaries, receiving €49 billion, ahead of shareholders (€42 billion) and employees (€6 billion);

- distributed earnings rose by 16% between 2016 and 2019, again with governments cashing in, as revenues rose 32% due to the dynamism of taxes on profits (+34%) and on dividends (+20%).

The coronavirus crisis is likely to make it more obvious that wealth creation by large companies is fundamental. It is vital for the employees and governments that benefit from it directly as well as for the entire ecosystem of subcontractors and partners that benefit indirectly.

THE FRENCH GOVERNMENT HAS BENEFITED GREATLY FROM THE CAC 40 COMPANIES’ SOCIAL AND FISCAL CONTRIBUTION

The study shows that governments were the second greatest beneficiaries of the CAC 40 companies’ growth, with €31 billion in production taxes, €37 billion in corporate income tax and €12 in taxes on dividends.

In recent years, the government has benefited from the increased yield on production taxes, up 27% for the CAC 40 since 2016, our estimates suggest. Revenues from production taxes in France are double the European average, according to Eurostat. These taxes, levied ahead of any corporate profit, amounted to 3.2% of French GDP in 2018, compared an average of 1.6% of GDP in the European Union and 0.4% in Germany. Though little known to the general public, they raise about €75 billion a year, far more than the corporate income tax, which brought in €33.5 billion in 2019.

Furthermore, the government has gained from the increased yield on the corporate income tax, up 34% for the CAC 40 companies since 2016, according to our calculations. The French tax rate is higher than average, with a ceiling of 31%, topped up by the 3.3% social contribution on income, bringing the maximum tax rate to 32%, the highest among the 35 OECD countries.

Finally, the government has benefited from taxation of dividends, which constitutes a second layer of taxation on distributed profits.

SHAREHOLDERS, THE KEY TO SHARED ECONOMIC DEVELOPMENT

The study shows that joint or individual shareholders come in behind employees and governments. They rank third among beneficiaries, with €42 billion in after-tax dividends. Far from grabbing most of the profits, they were part of a collective wealth creation chain that amounted last year to €389 billion in France and abroad.

In the last few weeks, the French authorities have sought to influence dividend distributions, quite apart from taxation, with the aim of lowering them. This political rallying cry, presented as a moral choice, was advanced without any economic impact studies. It will have negative economic and financial effects, with reduced capital movement and lower public revenues.

The study states that the government is entitled to request lower dividends at companies in which it holds shares through the Agence des participations de l’État (Government Shareholding Agency):

- The dividends received by the government from CAC 40 companies in which it us a shareholder are estimated at €1.4 billion for 2019, according to calculations by the Institut économique Molinari based on the latest annual report of the Agence des participations de l’État.

- The government receives more in dividends than the CAC 40 shareholder average: in the last four years, dividends from the portfolio of the Agence des participations de l’État amounted to 69% of net earnings, whereas regular shareholders received 52% of CAC 40 companies’ earnings.

- Government holdings in the CAC 40 are not doing as well as the French index. Between 2016 and 2019, their earnings fell by 39%, while earning of the CAC 40 as a whole rose by 11%.

- However, the reduction (Orange) or elimination (Engie, Renault, Safran and Thales) of dividends is not necessarily a good thing and should be decided on a case-by-case basis. This will reduce the government’s non-tax revenues, limiting its ability to support troubled companies.

The study notes that government interventionism in dividend distributions by private companies is neither legitimate nor desirable:

- Dividends are set at annual general meetings of shareholders. This makes it possible to take account of the various parties’ interests, reaching the most profitable consensus.

- Dividends paid by companies irrigate the economy. A significant portion of dividends is reinvested in other companies. This enables capital to move from mature players that require less capital toward companies with a greater need for capital to finance their development. Restraining dividend distributions artificially immobilises capital and could hinder wealth creation, worsening the situation.

- Restraining dividend distributions artificially also limits tax revenues. If the CAC 40 companies were to cut dividend distributions by half in 2020, the revenue shortfall for public administrations would be €6 billion, meaning €3.4 billion less for France’s public finances.

THE CRISIS MAKES FISCAL MODERATION ESSENTIAL

While there have been calls for higher taxes to offset the fragile state of public finances, the study shows that French companies continue to bear above-average taxation. This is a handicap affecting society as a whole, whether in times of growth or of crisis. Seeking to resolve the imbalances in French public finances by questioning tax cuts or raise taxes would be counterproductive.

The tax on dividends remains substantial despite the adjustments made with creation of the 30% flat tax. It slows reinvestment in the economy, and increasing it would be self-defeating. This would lead economic players to relocate their assets or to redirect their investments toward foreign companies that benefit from more competitive tax environments.

The corporate income tax is expected to go back down to 25% in 2022, or 25.8% with the social contribution on income factored in. This trajectory, bringing France closer to the OECD average, is fundamental. Deferring it would hurt the economic development of large French companies and the entire ecosystem they support.

France urgently needs to reduce or even dismantle its production taxes, which are calculated using tax bases disconnected from earnings (production facilities, payroll, revenues, etc.). Contrary to talk suggesting an interest in relocating industrial jobs to France, these taxes end up subsidising imports and offshoring. They create handicaps in normal times and economic damage in a time of crisis.

Taxing French companies more than the average is a choice that penalises all of society. Companies have to pass along higher taxes to consumers, employees or shareholders. For example, this causes companies to pass along taxes to their customers, eroding the quality/price ratio so as to maintain market share. It holds back wages in France and boosts incentives to create jobs outside France. It drives some companies to pay shareholders less, at the risk of encouraging them to look elsewhere. Taxes are piled on top of taxes, with each euro of profit distributed as dividends subject to the tax on dividends, the corporate income tax based on profits and production taxes based on numbers that have no connection with earnings.

A BASIC ECONOMIC APPROACH

This study provides original numbers on the sharing of the wealth created by the CAC 40 companies and on the sharing of earnings.

The social and fiscal contribution from large companies in France and worldwide remains largely unrecognised. Traditional accounting and financial presentations do not provide for externalisation of the creation of value for the broader community. Devised to present corporate earnings, they focus on financial data and understate the benefits for the French and global community while overstating shareholders’ income by presenting dividends before taxes.

This study aims to remedy this. It identifies and quantifies the gains for employees, governments and shareholders with a sound, robust and well documented. It aims at showing orders of magnitude allowing for a true debate on the creation and sharing of the wealth created by businesses.

THE REPORT IS AVAILABLE (IN FRENCH) AT: https://www.institutmolinari.org/wp-content/uploads/2020/06/entreprises-cac40-2020_fr.pdf

QUOTES

Cécile Philippe, President of the Institut économique Molinari and co-author

”In a time of crisis, common sense would have suggested refraining from putting pressure on large companies to reduce their dividends. Urging companies to withhold dividends and to retain capital that they may not need ends up penalising other companies that could have made better use of this resource. A large portion of dividends is reinvested. When governments curb distribution of these dividends, they are curbing their redistribution and their reinvestment in other companies.

“It could make sense for the government to urge companies in which it holds shares to refrain from distributing dividends. But the government should not meddle in the governance of companies in which it is not a shareholder.

“In the last few years, the companies in which the government holds shares have distributed more in dividends than the CAC 40 companies on average even as their earnings declined significantly, down 39% between 2016 and 2019, in contrast to the CAC 40 companies as a whole.”

Nicolas Marques, Director of the Institut économique Molinari and co-author

“In France, the government spends too much time lecturing companies and shareholders and too little time eliminating the constraints that hinder economic development. It has a propensity to organise confusion, interfering in the work of other stakeholders and failing to address the priorities that are within its purview. By meddling in dividend distribution, it is sending a counterproductive message of distrust. The government might have been expected to direct its energy toward lowering production taxes, which are asphyxiating the French economy and end up being an unemployment creation machine, rather than telling shareholders what to do.”

ABOUT IEM

The report is written by Cécile Philippe and Nicolas Marques of the Institut économique Molinari (IEM).

The Association Institut économique Molinari has as its purpose to create greater understanding of economic phenomena and challenges and to make them more accessible to the general public. Accordingly, it conducts scientific research, organizes think tanks, produces publications and provides training and varied forms of teaching toward this end to the broadest possible audience.

FOR INFORMATION OR INTERVIEWS, CONTACT THE AUTHORS

• Cécile Philippe, President Institut économique Molinari (Paris, French or English),

cecile@institutmolinari.org, +33 6 78 86 98 58

• Nicolas Marques, Director Institut économique Molinari (Paris, French),

nicolas@institutmolinari.org, +33 6 64 94 80 61