The pitfalls of so-called “sin” taxation

Economic Note

Read the Economic Note in PDF format… | Read the Media release…

Economic Note prepared by Valentin Petkantchin, associate researcher at the Institut économique Molinari

A growing number of new taxes in various countries aim to change the public’s consumption habits. To the taxation of products such as alcohol, tobacco and gambling are being proposed new measures that in effect target certain foods or drinks (the fat tax, the soda tax, the Nutella tax) or entertainment products (video games).

This “behavioural” taxation, generally referred to as “sin taxes,” is hardly new. While these taxes can obviously provide additional public revenues, they should be viewed with caution, because they often prove ineffective and are a source of many unintended effects. Not only do “sin taxes” generally fail to meet their stated goals, but, by artificially raising prices on the legal market, they are a source of distortions and illegal trafficking, synonymous with increased violence and corruption.

AN “OLD” CONCEPT

Taking the existence of harmful effects from consuming a given product and using it as a pretext can be politically attractive. This can make it easier to adopt a new tax (or to raise an existing one). The stated logic consists of bringing in additional tax revenues with the argument that over-taxing the product would deter consumption, resulting in “social” benefits in terms of public health, for instance.

This logic for increasing tax revenues is far from new. On the contrary, it has often been used by public authorities who have long imposed various taxes of this type. In concrete terms, these taxes most often take the form of excise duties or other indirect contributions(1) applied specifically to the targeted product, on top of the general taxes applied to all goods and services, like the value added tax (VAT). Examples of this abound.

Tax on the vice of “drinking”

Attempts to control alcohol consumption go back thousands of years. Like tobacco, alcohol was among the first products to enter the crosshairs of prohibitionists. The inventor of rice wine was punished by the Chinese emperor in 2200 B.C.(2) In 1122 B.C., grape wine was prohibited and the vines destroyed. Measures in later centuries and in numerous countries to limit abuses in alcohol consumption have been many and varied.

Taxes on spirits were among the first excise duties instituted in England in the mid-18th century. In the United States, the very first tax adopted in 1791 was the excise duty on whisky, justified notably by the argument that this measure would have a positive impact “from the standpoint of health and morality.”(3) It provoked the famous “Whisky Rebellion” by members of the public as a sign of protest.

Today alcohol remains heavily penalised by specific taxes.

Tobacco and the smoker’s vice

For a long time, tobacco has also been a favourite target of established authorities. After it appeared in Europe, its consumption was severely stigmatised by public and religious authorities, along with heavy penalties ranging up to the excommunication of “anyone who may smoke in a religious building.”(4)

In this climate of scorn, it became easy for James I to raise import duties on tobacco by 4,000% in England in 1604, under the pretext that smoking was “a custom loathsome to the eye, hateful to the nose, harmful to the brain, dangerous to the lung.”(5)

The opportunity to increase tax revenues by taxing tobacco consumption was also seized in France. The first tax on importing tobacco was instituted by Richelieu in 1629, before Colbert established a state monopoly on the production and sale of tobacco several years later.(6)

Margarine tax and “unfair” competition

“Sin” taxes do not end at alcohol and tobacco. Taxes have been imposed on various other products under diverse pretexts. Public health has often been invoked as a pretext, as has protecting local producers against competition from new products.

A specific tax on margarine was imposed in the late 19th century in the United States in the guise of fighting the “unfair competition” it represented for milk producers on the domestic market.(7) In Finland, a similar tax was imposed between 1934 and 1942 for similar reasons. This excise duty was aimed at deterring the consumption of margarine — produced using imported ingredients — to protect domestic butter production.(8)

THE “SOCIAL COST” ARGUMENT

Beyond considerations of a moral nature, public authorities and supporters of behavioural taxes also point to the existence of “social costs.”

The idea is as follows. Consumers of vice-related products are presented as a burden on the community (namely taxpayers), and a drag on government finances. It is then suggested that suppressing their “vices” would help bolster the public accounts.

In the United States, a figure of $147 billion was advanced as the cost of dealing with the consequences of obesity in 2008 and was used to justify a new tax on soft drinks.(9) In France, annual health insurance spending on obesity and excess weight may be 10 billion euros.(10) Similar figures are presented for tobacco and alcohol. The health costs of tobacco may be $96 billion in the United States from 2000 to 2004, and they may reach $193 billion counting the costs from loss of productivity.(11) Similarly, in France, tobacco-related health insurance spending may have been 12 billion euros in 2010,(12) with the overall “social” cost estimated at 47.7 billion euros. And the social cost of alcohol is evaluated at 37 billion euros.(13)

These figures are impressive. But there is reason to doubt an automatic link between the disappearance of “vices” targeted by behavioural taxation and stronger public finances. Why? First, the way this is calculated leaves much to be desired. Rather than focus on extra costs in a given year from people engaging in their vices, what should be taken into account are the lifetime health costs run up by these people throughout their lives and then comparing these costs with those of people who steer clear of these vices and lead healthy lives.

The latter generally live longer, with higher life expectancy. This means they give rise to other health care costs — which are especially substantial at an advanced age — that offset or maybe even exceed all the extra costs generated by obese people or smokers over their lifetimes.(14)

Based on data for the Netherlands, a study concludes that, if we focus solely on costs at a given age, we can observe extra costs of 40% among smokers. But if there were no smokers, health care costs for the population as a whole would be 7% higher among men and 4% higher among women than they are at present, with a mixed population that included both smokers and non-smokers.(15)

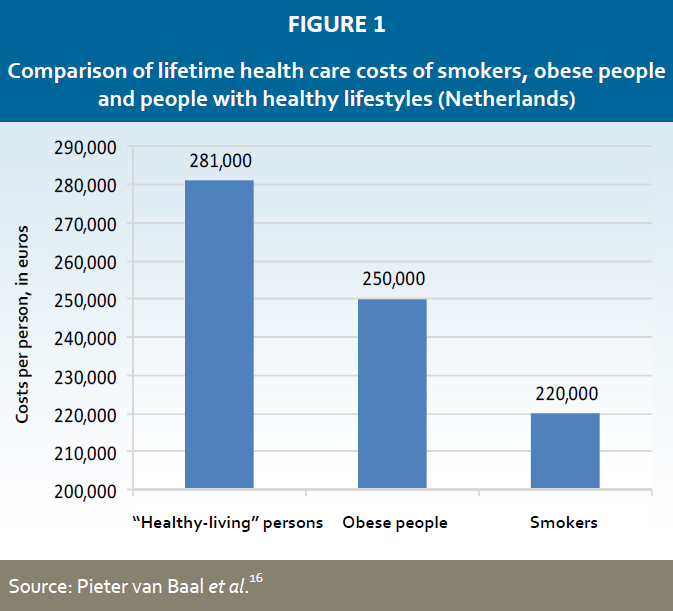

As regards obesity, another study concludes that “[a]lthough effective obesity prevention leads to a decrease in costs of obesity-related diseases, this decrease is offset by cost increases due to diseases unrelated to obesity in life-years gained.” Over all, the costs of non-smokers of normal weight may be nearly 28% higher than those of smokers and 12% higher than those of obese people (see Figure 1). The disappearance of smoking and obesity would not, in this case, provide for any strengthening of public accounts but would actually weaken them.

As regards obesity, another study concludes that “[a]lthough effective obesity prevention leads to a decrease in costs of obesity-related diseases, this decrease is offset by cost increases due to diseases unrelated to obesity in life-years gained.” Over all, the costs of non-smokers of normal weight may be nearly 28% higher than those of smokers and 12% higher than those of obese people (see Figure 1). The disappearance of smoking and obesity would not, in this case, provide for any strengthening of public accounts but would actually weaken them.

Second, according to the logic of those using this argument, it would be necessary to take into account the impact of the early deaths of “vice” consumers on other government budget items, particularly with respect to retirement or care of the elderly. The impact of “vices” disappearing and lifespans growing longer could have an effect opposite to what is suggested by supporters of sin taxes, worsening rather than relieving the public accounts over time.

Taking account of the items mentioned above, a study evaluates the overall financial impact of smoking in the United States as a “saving” of $0.32 per pack of cigarettes.(17) Clearly, any estimate of the “social cost” of “vices” depends on the calculation methodology applied. From one country to the next, many parameters and the available data may vary.

One thing is certain. We are nowhere close to unanimity on the social cost of vice behaviours. In addition, even if the cost turned out to be positive, two additional factors must be considered before an overall judgment is arrived at.

On the one hand, the notion of social cost and weight in connection with public finances arises from public authorities having imposed compulsory public systems in the area of health care and health insurance. Risk assessment has been cast aside. In other words, the extra tobacco- or obesity-related costs weighing down public budgets, if they really exist, are an unexpected and undesirable effect of the existence of these systems. This should obviously have been taken into account before they were imposed. These public costs are not a characteristic inherent to consumption of alcohol, tobacco or fatty or sugary foods.

In a competitive private market, with risk management allowed, smokers who truly present a higher risk would be obliged to pay higher premiums. Proof of this is found, for example, in loan insurance, where this appears to be precisely the practice of some insurers in France, with the cost of insurance depending in part on whether an insured person is a smoker and on body mass index.(18) The costs are therefore borne by “vice” consumers themselves, and any potential “burden” on the public accounts would disappear at the same time.

The existence of these “external costs” in the current public systems does not necessarily justify sin taxes, which may not be an appropriate means. Such taxes generally hit all consumers (and all producers), whereas abusive consumption of a targeted product — such as alcoholic drinks, soda, high-fat or highly sweetened foods, etc. — is what often lies at the root of health or social problems. In seeking to correct this “externality,” taxation ends up creating a new and possibly greater one by imposing new “costs” or negative externalities on all consumers, who are unjustifiably required to pay more for their products on a daily basis.(19)

MIXED AND UNEXPECTED EFFECTS ON PUBLIC HEALTH

If, on paper, public health is often the stated aim of sin taxes, a number of reasons explain why this aim is not usually achieved in reality. Instituting a tax may actually have unexpected effects.

While official sales of an overtaxed product clearly are likely to

decline, consumers tend to substitute other products that may be just as harmful as the targeted product, or more so. This ends up compromising fulfilment of the health goals put forth by public authorities.(20) The U.S. experience with soda taxes shows, for example, that consumers — children and teenagers especially — switch to other high-calorie drinks that are relatively inexpensive, meaning there is little or no effect on excess weight and obesity.(21) When public authorities start taxing fat, as in Denmark in 2011, consumers increase their cross-border purchases and turn to less expensive products that may present just as great a health risk in case of

excess consumption, or even a greater risk due to lower quality.(22) The same phenomenon affects alcohol, with taxes driving consumers toward cheaper and stronger alcoholic drinks(23) or possibly toward the use of other drugs such as cannabis instead of alcohol.(24)

Even in the case of tobacco, often cited as an example, taxes are related to similar adverse effects. As noted in a study, “[a] growing body of research shows that many smokers respond to cigarette taxes in dangerous ways.”(25) Though tobacco consumers are likely to reduce the number of cigarettes they smoke, they also tend to increase the tar and nicotine consumed per cigarette smoked, either by turning toward more powerful cigarettes or by smoking each cigarette more intensely. The result? “Cigarette excise taxes appear to have no effect on total tar consumption,”(26) the factor viewed specifically as causing cancer. Moreover, since giving up smoking often leads to weight gain, other studies find that “cigarette taxes increase obesity, perhaps significantly.”(27)

A CAUSE OF THE BLACK MARKET AND ILLICIT TRAFFICKING

Instituting sin taxes automatically opens the door to the black market.

This market may take the form of cross-border purchases — as in the case of the fat tax that led Danes to purchase products in Germany or Sweden — and/or actual black market purchases, which altogether may account for 10% of the alcohol market in the United Kingdom and 20% or more of the cigarette market in France.(28)

These phenomena follow an implacable economic logic. Once a product’s price is detached from economic reality because of taxation, this creates a profit margin that traffickers will not hesitate to grab, especially when it exceeds the risks and costs of getting caught.

In public debate, we often lose sight of the fact that it is not the nature of an overtaxed product in itself or a “vice” that lies at the root of contraband but rather taxation that is the necessary and sufficient cause. Even ordinary products such as salt or soap can quickly become the object of contraband if it is heavily taxed.

Proof is provided by the example of the salt tax in France in the 17th and 18th centuries (known as the gabelle), renowned for the intensive contraband that grew up around it — or the soap tax in England, with soap subjected, until the mid-19th century, to a specific and very heavy tax that could reach 110% to 120% of its price. This taxation could not fail to give rise “to many frauds and an active contraband.”(29) As noted by a specialist on this issue, “[s]o long as a profit of 110 or 120 per cent was to be made by breaking the law, so long was it sure to be broken, despite the multiplication of penalties and the vigilance of the officers.”

Finally, taxes stimulate the black market and contraband all the more in that they go together with value added taxes and are “regressive,” meaning that low-income people are relatively hard hit by them. These will be the first people to turn to the black market because of a need to preserve their purchasing power.

Finally, taxes stimulate the black market and contraband all the more in that they go together with value added taxes and are “regressive,” meaning that low-income people are relatively hard hit by them. These will be the first people to turn to the black market because of a need to preserve their purchasing power.

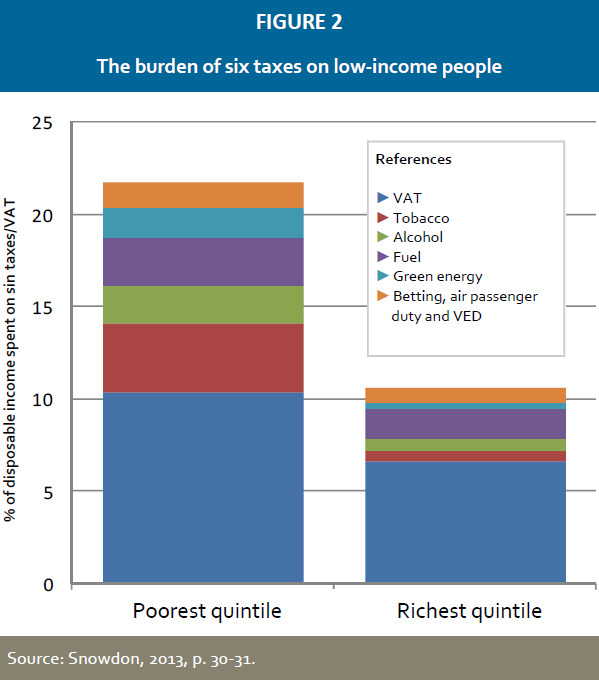

As noted in a study dealing with the United Kingdom, all behavioural taxes (notably taxes on fuel and vehicles as well as those on green energy aimed at altering behaviour in energy consumption) can amount to 11.4% of disposable income for the poorest people, reaching 21.7% if VAT is included, double the comparable figure for the wealthiest. (See Figure 2)(30)

CONCLUSION

With governments seeking additional tax revenues to put the public accounts in order, new taxes — or hikes of existing taxes, as in the case of tobacco or alcohol — are being proposed. This type of taxation with its behavioural aims is being advocated for various sweet or salty foods and for soft drinks as well as for energy or various entertainment products.

The existence of “social costs” related to consumption of the targeted products is being mentioned systematically to persuade public opinion that a decline in “vices” would help strengthen the public accounts. The existence of such “costs” and their scope are by no means certain, even in the case of a product seen as seriously harmful, such as tobacco.

Instituting these taxes must be approached with the greatest caution, with this type of taxation producing many adverse effects. It causes distortions and waste while driving consumers to substitute products of lesser quality that are at least as harmful to the health, with the sole aim of avoiding a tax. Taxes such as these are the primary reason for the existence of a black market and illicit trafficking, with their share of crimes, violence and corruption.

References

1. When a product is imported, the tax may also take the form of a customs duty at the time of importation.

2. See Adam Gifford, Jr., « Whiskey, Margarine, and Newspapers: A Tale of Three Taxes, » in Taxing Choice, ed. W.F. Shughart II, 1997, p. 2, available at: http://www.csun.edu/~hceco001/Researchpapers/sintaxes.pdf.

3. Gifford, Jr., 1997, op. cit., p. 3. See also Richard Williams et al., « Taxing Sin, » Mercatus Center, George Mason University, July 2009, p. 1, available at: http://mercatus.org/publication/taxing-sin.

4. See Marc Kirsch, « Genèse d’une épidémie, » La Lettre du Collège de France, Special Issue 3, 2010, p. 6. Some 1,624 priests who took tobacco were excommunicated in this way.

5. See Harry Clarke, « Taxing sin: some economics of smoking, gambling and alcohol, » The Melbourne Review, Vol. 4, No. 2, November 2008, p. 30.

6. See « Les archives font du tabac, » Conseil général du Morbihan, available at: http://www.cg56.fr/pdf/AD_Dossier_tabac.pdf.

7. See Gifford, 1997, op. cit., pp. 10-11.

8. See Leila Juanto, « Excise Duties in Finland in a Historical Perspective, » Scandinavian Studies in Law, Vol. 44, 2003, p. 146.

9. See Frank J. Chaloupka et al., « Sweetened beverages and obesity: the potential impact of public policies, » Journal of Policy Analysis and Management, Vol. 30, No. 3, p. 645.

10. See the information report from National Assembly member Valérie Boyer, En conclusion des travaux de la mission sur la prévention de l’obésité, French National Assembly, September 30, 2008, p. 26, available at: http://www.assemblee-nationale.fr/13/pdf/rap-info/i1131.pdf.

11. See the information sheet, « Smoking & Tobacco use, » Centers for Disease Control and Prevention, available at: http://www.cdc.gov/tobacco/data_statistics/fact_sheets/fast_facts/.

12. See the French Court of Auditors evaluation report titled « Les politiques de lutte contre le tabagisme, » December 2012, p. 37, available at:

http://www.ccomptes.fr/Actualites/Archives/Les-politiques-de-lutte-contre-le-tabagisme.

13. See Pierre Kopp and Philippe Fenoglio, « Le coût social des drogues en 2003, » Observatoire français des drogues et des toxicomanies, April 2006, pp. 3 and 55.

14. See, for example, Jan Barendregt et al., « The health care costs of smoking, » The New England Journal of Medecine, October 1997, pp. 1052-1057. The authors conclude (p. 1052) that « [s]mokers have more disease than nonsmokers, but nonsmokers live longer and can incur more health costs at advanced ages. »

15. Ibid. On the other hand, Susanne Rasmussen et al., « The total lifetime costs of smoking, » European Journal of Public Health, 2004, No. 14, find, by including more supposedly tobacco-related illnesses, that smokers — even with their early deaths taken into account — require higher health care spending than non-smokers. In France, Pierre Kopp and Philippe Fenoglio, « Les drogues sont-elles bénéfiques pour la France?, » Revue économique 2011/5, Vol. 62, p. 910, estimate the « savings » linked to the early deaths of smokers at 771.7 million euros, while the extra costs may be more than 18 billion euros.

16. Pieter van Baal et al., « Lifetime medical costs of obesity: prevention no cure for increasing health expenditure, » PLoS Med 5(2) e29, p. 245. This refers to projected costs, at age 20, with remaining life expectancies of 64.4 years for « healthy lifestyles », 59.9 years for obese people and 57.4 years for smokers.

17. See W. Kip Viscusi and Joni Hersch, « Tobacco regulation through litigation: The Master Settlement Agreement, » NBER Working Paper 1422, October 2009, p. 3. See also W. Kip Viscusi, « The government composition of the insurance costs of smoking, » Journal of Law and Economics, Vol. 42, No. 2, October 1999, p. 593. This involves an estimate in 1995 dollars with a 3% discount rate; without the discount, the financial « savings » would be $1.72 per pack, while at a 5% rate, smoking would « cost » 33 cents per pack. With a 6% rate, Kopp et al., 2011, op. cit., p. 14, evaluate tobacco’s impact on French public finances during 2000 at -3.9 billion euros (taking product taxes into account); for alcohol, in contrast, it would be positive (4.8 billion euros).

18. See, for example, Eric Gissler et al., « Assurance-Emprunteur, » Inspection générale des finances, November 2013, p. 12, available at:

http://www.igf.finances.gouv.fr/webdav/site/igf/shared/Nos_Rapports/documents/2013/2013-M-086-02_rapport.pdf. See also Appendix 6, p. 9.

19. Studies suggest that, with higher taxes on alcohol or junk food, it is moderate drinkers or people with balanced lifestyles who would be most likely to reduce their consumption. See Jason Fletcher, « Soda Taxes and Substitution Effects: Will Obesity be Affected?, » Choices, 26(3), July 2011, available at: http://ageconsearch.umn.edu/bitstream/117066/2/cmsarticle_188.pdf, and Manning et al., « The demand for alcohol: the differential response to price, » Journal of Health Economics, 14(2), June 1995, pp. 123-148.

20. Similarly, producers are driven to alter products at the margins with the sole aim of escaping a tax, causing a waste of economic resources and a product range further removed from consumer preferences.

21. See Valentin Petkantchin, « La taxe « sodas », une mesure inefficace pour régler les problèmes d’obésité et de déficit public, » Institut économique Molinari, October 2011, available at:

https://www.institutmolinari.org/la-taxe-sodas-une-mesure,1214.html.

22. See Valentin Petkantchin, « ‘Nutrition’ taxes: the costs of Denmark’s fat tax, » Institut économique Molinari, May 2013, available at: https://www.institutmolinari.org/IMG/pdf/note0513_en.pdf. The tax was ended in 2012.

23. See Paul Gruenwald et al., « Alcohol prices, beverage quality, and the demand for alcohol: quality substitutions and price elasticities, » Alcoholism: Clinical and Experimental Research, 30(1), January 2006, pp. 96-105.

24. See, for example, Benjamin Crost and Santiago Guerrero, « The effect of alcohol availability on marijuana use: evidence from the minimum legal drinking age, » Journal of Health Economics, Vol. 31/1, January 2012, pp. 12-121, as well as the references cited on this topic.

25. Gary Lukas, Jr., « Saving smokers from themselves: The paternalistic use of cigarette taxes, » University of Cincinnati Law Review, Vol. 80/3, 2012, p. 38.

26. Matthew Farrelly et al., « The Effects of Higher Cigarette Prices on Tar and Nicotine Consumption in a Cohort of Adult Smokers, » Health Economics 13, 2004, p. 56.

27. See Lukas, 2012, Op. cit., p. 40, as well as the references cited on this topic.

28. See Valentin Petkantchin, « What if tobacco were simply prohibited?, » Institut économique Molinari, January 2012, p. 3, available at: https://www.institutmolinari.org/et-si-on-interdisait-tout,1265.html.

On alcohol, see, for example, Christopher Snowdon, « Drinking in the shadow economy, » Institute of Economic Affairs, Discussion paper No. 43, October 2012, p. 4, available at:

http://www.iea.org.uk/publications/research/drinking-in-the-shadow-economy.

29. See Esquirou de Parieu, Traité des impôts, 1866, Second Volume, published by Cotillon, Guillaumin et Compagnie, p. 484.

30. Christopher Snowdon, « Aggressively regressive: The ‘sin taxes’ that make the poor poorer, » Institute of Economic Affairs, October 2013, p. 31, available at:

http://www.iea.org.uk/publications/research/aggressively-regressive-the-sin-taxes-that-make-the-poor-poorer.