Europe is short more than €19,000 billion in stock market capitalisation and retirement savings

Paris, May 3, 2025 – The Institut Economique Molinari has published a new assessment of Europe’s shortfall in savings, explaining why the European Union is lagging behind in innovation and lacking leaders in technology. Pension funds need to be rolled out across Europe to make up for this shortfall.

Insufficient funding for innovation in Europe

For every young tech leader in Europe, the US has 17: At the end of 2023, European stock exchanges listed only 14 companies under the age of 50 with a market capitalisation of $10 billion or more, compared with 241 such companies in the United States.

For every $1 invested in Europe’s young tech firms, their US counterparts have $68: The recent market capitalisation of these same European companies was barely $434 billion. Their equivalents in the US were valued at $29,566 billion, 68 times more.

50% less R&D as a percentage of GDP: European business investment in R&D represents just 1.2% of GDP, remaining persistently lower than in the United States, where R&D claimed 2.4% of GDP in 2021.

Only one tenth as much venture capital: In 2023, the EU accounted for only 5% of all venture capital funds raised worldwide, compared with 52% for the United States.

Almost total tech dependence: The digital dependence index (DDI) of Germany, France, the UK and Italy on the United States for infrastructure and platforms is 0.98 (where 1.0 represents total dependence).

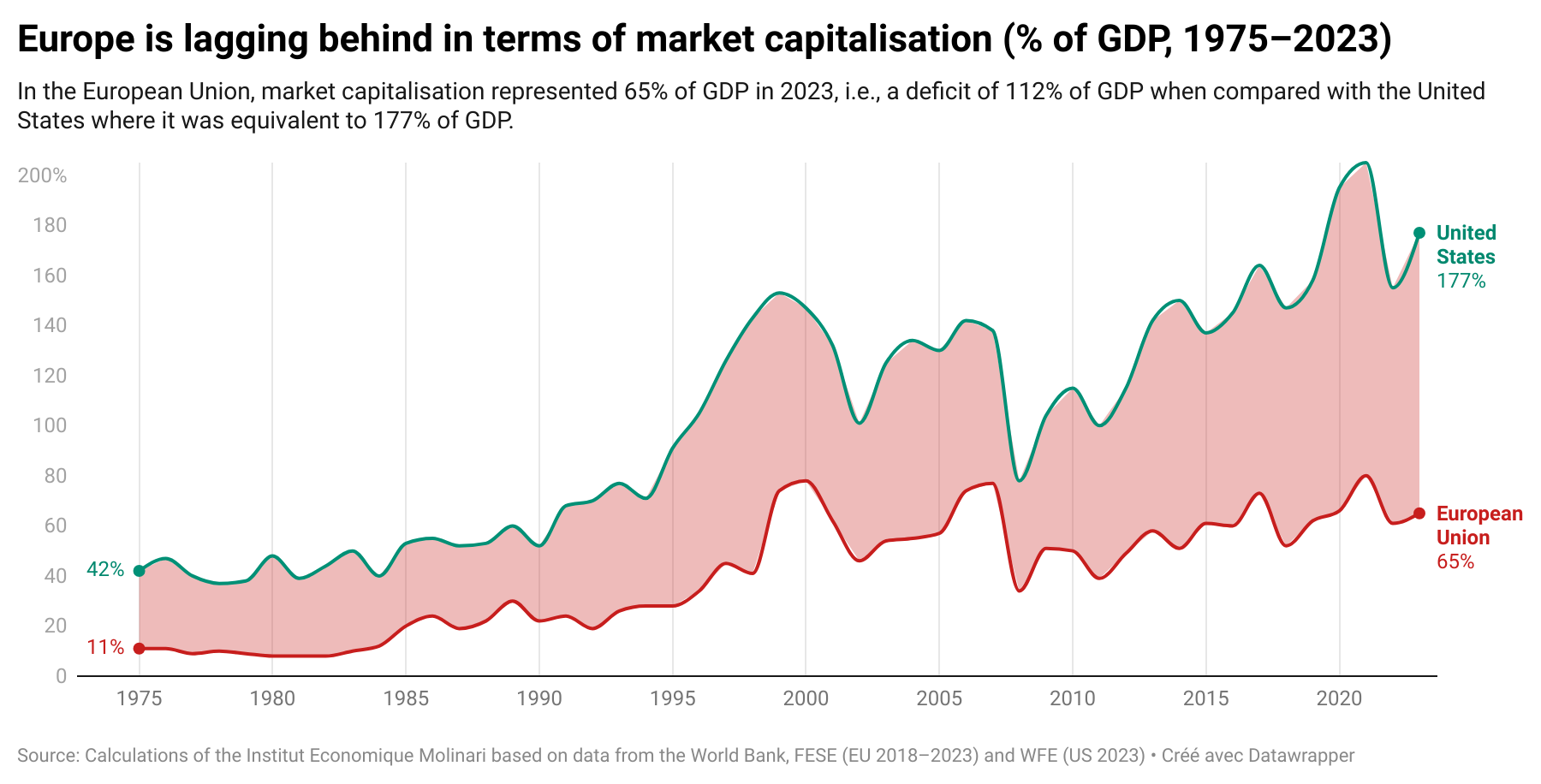

Stock market capitalisation €19,300 billion behind

The capitalisation of EU companies represented 65% of GDP in the European Union, compared with 177% of GDP in the United States at the end of 2023. The difference, i.e., 112% of EU GDP, corresponds to a European market capitalisation gap of €19,300 billion.

In a world where equity capital is used to finance disruptive innovations, European companies’ lack of market capitalisation means that they are falling behind in the race to innovate and thus losing out economically.

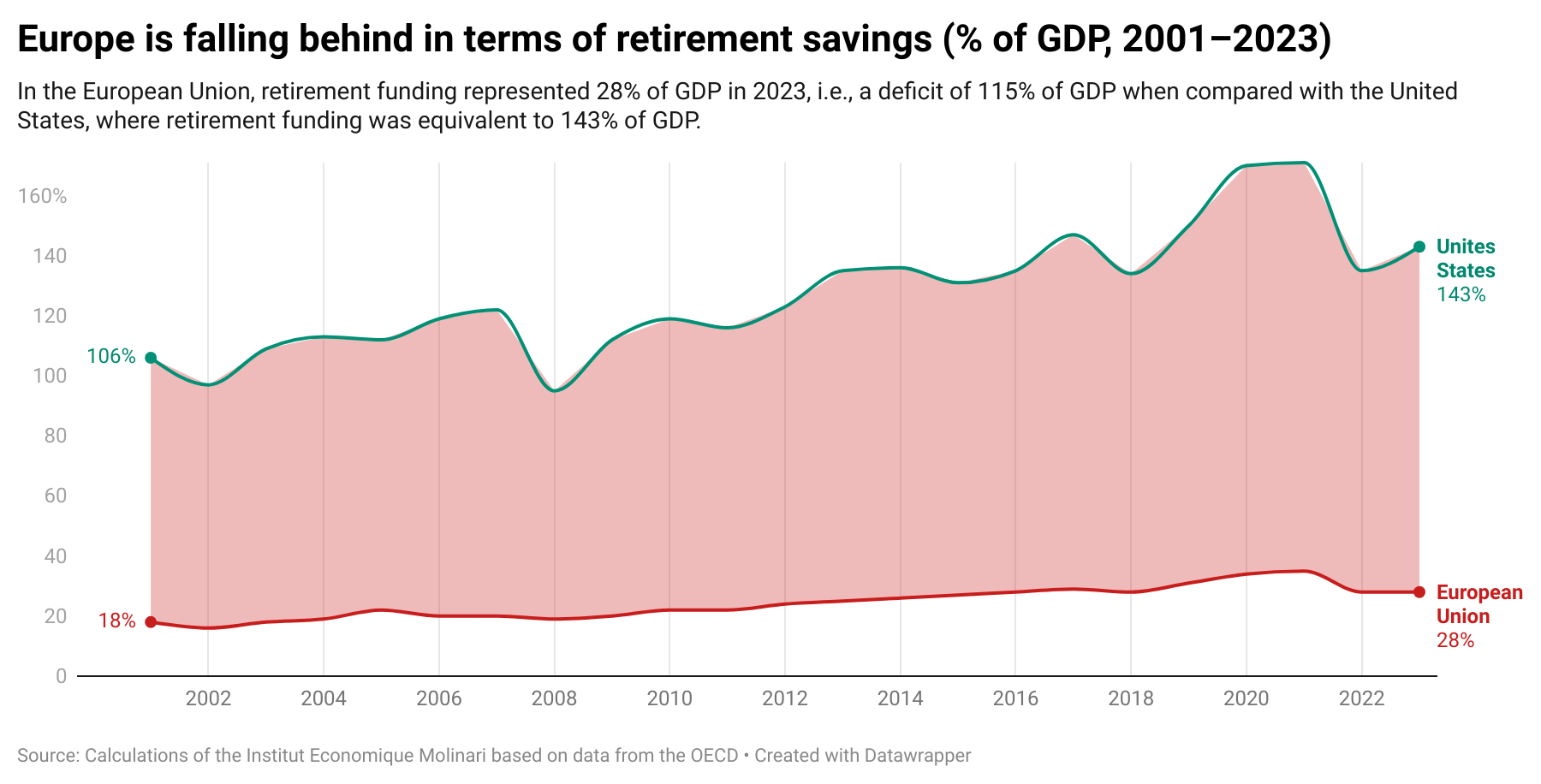

€19,700 billion shortfall in retirement funding

With respect to the United States, the EU was €19,700 billion behind in retirement savings at the end of 2023. In Europe, retirement savings represented 28% of GDP at the end of 2023, compared with an average of 143% in the United States, a shortfall of almost 115% of GDP.

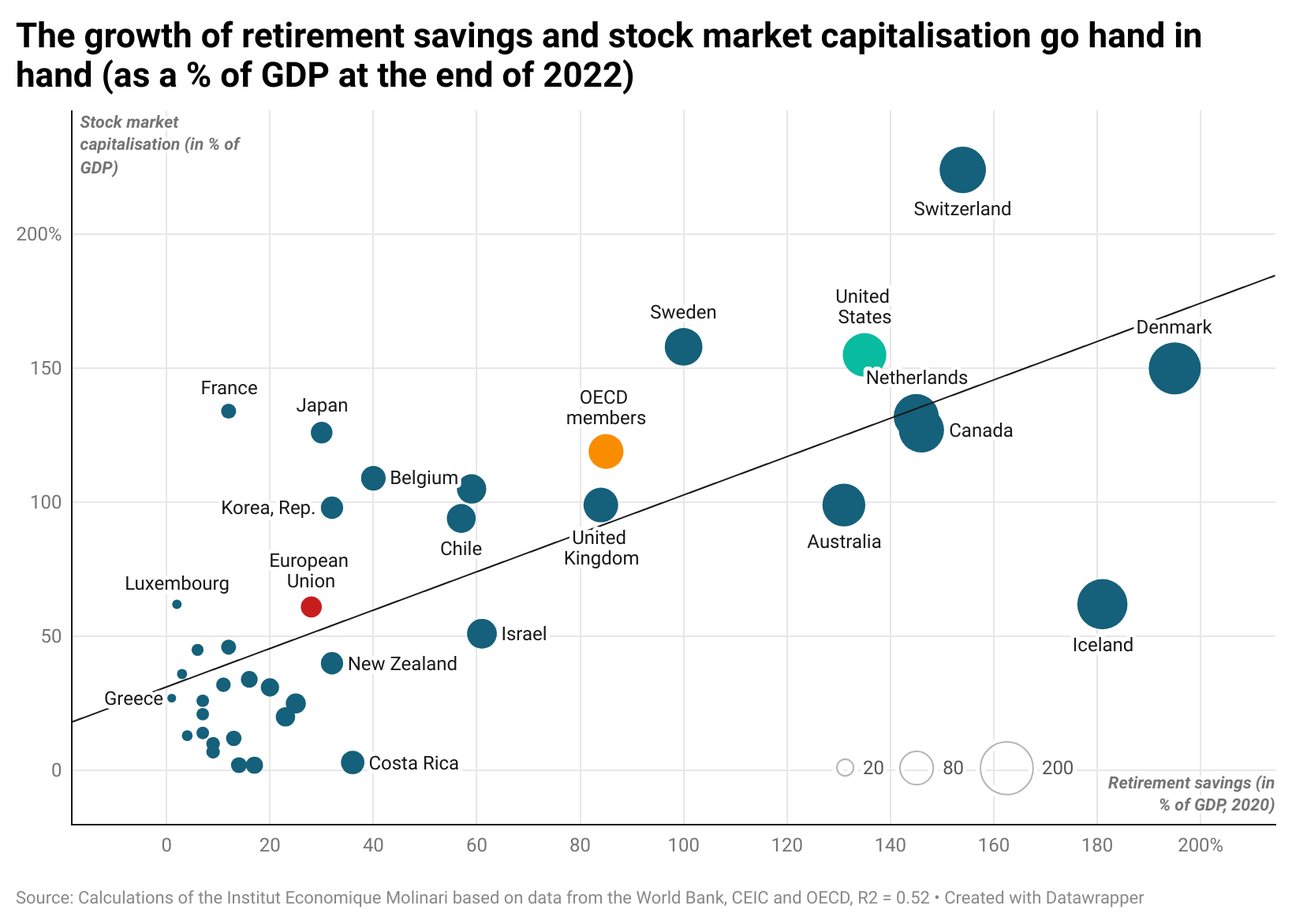

The lack of stock market capitalisation is directly linked to the European retirement savings deficit, because retirement savings are invested over the long term, on average for more than twenty years (since a working life lasts more than 40 years).

The only solution is the widespread use of pension funds

The lack of retirement savings in Europe represents a real handicap for the financing of our enterprises. Pension funds, usually long-term investors, invest extensively in equities and also favour their countries of origin, with an average of 56% of assets invested at home.

For Europe to catch up, the best solution would be widespread use of pension funds, both in the private sector, and to fund the pensions of civil servants in the public sector.

The current strategy of both France and the European Commission aims to reallocate existing savings, but this is not at all sufficient to compensate for the chasm between Europe and the United States. A large proportion of household wealth is made up of property or very short-term investments. Even life insurance fails to make up for the lack of pension funds in Europe because, available as it is at any time, it cannot be invested in equities to the same extent as retirement savings.

QUOTES

Cécile Philippe, President of the Institut Economique Molinari

“According to the Governor of the Banque de France, the European capital deficit is €300 billion. This estimate falls far short of reality. Indeed, the calculations of the Institut Economique Molinari arrive at more than 50 times that figure.

“Our calculations are in line with the numbers showing the difficulty of financing European priorities, with €450 billion a year from 2025 to 2030 to finance the energy transition, almost €300 billion a year for digital technology and productivity, and €800 billion for rearmament. Without a proper assessment of the shortage of long-term capital in Europe, the Commission’s action plans are just an exercise in futility.”

Nicolas Marques, Director General of the Institut Economique Molinari, author

“Europe suffers from major twin deficits, linked to the underdevelopment of retirement savings and its stock market capitalisations, amounting to €19,700 billion and €19,300 billion in 2023.

“While it’s clear that unifying markets is a desirable approach and that financial and insurance regulations need to be made more flexible to encourage investment in equities, this will in no way make up for how far Europe has fallen behind with respect to long-term capital.

“Only the widespread introduction of pension funds in all European countries where they are currently non-existent will significantly improve the financing of the economy and, at the same time, improve the value for money of pensions, and reduce public deficits.”

STUDY

Link to study Relancer l’innovation en Europe en développant l’épargne et les capitaux longs (In French only, 30 pages): https://www.institutmolinari.org/wp-content/uploads/2025/05/etude-relancer-innovation-en-europe-2025.pdf

DATAWRAPPER GRAPHICS

Shortfall in market capitalisation: https://www.datawrapper.de/_/2RS5X/

Shortfall in retirement savings: https://www.datawrapper.de/_/S1jWl/

Link between stock market and retirement capitalisations: https://www.datawrapper.de/_/qCThY/

FOR MORE INFORMATION OR INTERVIEWS, PLEASE CONTACT:

Nicolas Marques, Director General of the Institut Economique Molinari

(Paris, French language)

nicolas@institutmolinari.org

+ 33 6 64 94 80 61

Or Cécile Philippe, President, Institut Economique Molinari

(Paris, Bruxelles, English or French language)

cecile@institutmolinari.org

+33 6 78 86 98 58

ABOUT THE IEM

The Institut Economique Molinari (IEM) is a research and educational organization whose mission is to promote individual freedom and responsibility. The Institute aims to facilitate change by stimulating debate around the conventional wisdom that generates the status quo. It aims to encourage the emergence of new consensus by proposing economic analysis of public policies, by illustrating the value of exchange, or by demonstrating the benefits of more lenient taxation and regulation. The IEM is a non-profit organization financed by the voluntary contributions of its members: individuals, companies or foundations. As an intellectually independent organization, it accepts no public funding.