France retains top ranking in taxation of the average worker for the fifth year in a row, despite the 2020 tax cut

Paris, July 18, 2020 – Using data calculated by EY, the Institut économique Molinari is issuing its 11th annual study on the real social and fiscal pressure faced by the average wage earner in the European Union (EU).

This ranking has the distinct feature of providing figures for the current year on the social and fiscal pressure faced by the average worker, applying a solid, uniform methodology across all 27 EU member countries. It provides a firm understanding of the real impact of taxes and charges and the changes they are undergoing.

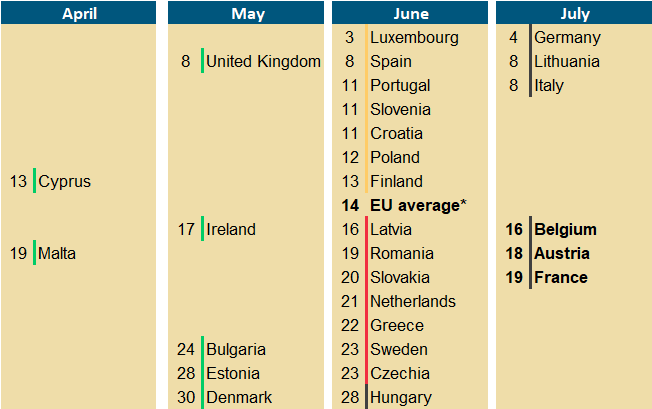

2020 TAX AND SOCIAL CHARGE FREEDOM DAYS FOR THE AVERAGE WORKER

* The United Kingdom, which left the European Union on January 31, is not included in the calculation of this average, which is based on the current 27 EU member countries.

WHAT THE 2020 NUMBERS TELL US ABOUT FRANCE AND EUROPE

France remains the EU taxation champion for the fifth year in a row despite this year’s tax cut:

- Social and fiscal freedom day falls on July 19, as in 2019. Average employees have to work until then to finance public spending. After that date, they may benefit from the fruits of their labour as they see fit.

- The gap is one day with Austria (July 18), two days with Belgium (July 16) and 35 days with the EU 27 average (June 14).

- Taxation on the average worker in France amounts to 54.68% in 2020, down by a sliver (-0.05%) from last year due to an income tax cut announced following the “yellow vest” crisis.

- This gain amounts to €126 over the full year for the average unmarried worker. This is 3.4 times less than the change seen in 2019, when a reduction in social charges came to €403, after deducting increases in the generalised social contribution and in income tax.

Austria comes in second, with social and fiscal freedom day on July 18, one day earlier than last year:

- Taxation on the average worker amounts to 54.46% in 2020, down from last year (-0.26%). This change results from the rate applied to the first income tax bracket being lowered from 25% to 20%.

- First planned for 2021, this reduction was implemented ahead of time, resulting in a €350 tax saving in 2020. Without this measure, Austria would have been the leader in taxation of the average worker in 2020, with social and fiscal freedom day falling on July 20.

Belgium is third on the podium, with social and fiscal freedom day on July 16, one day later than in 2019:

- With its “tax shift”, the former number 1 in this ranking (from 2011 to 2015) became number 2 (in 2016 and 2017) and then number 3 in 2018.

- Belgium remains number 3 in 2020, with 53.76% in social and fiscal pressure on the average worker, up from last year (+0.13).

Germany ranks sixth, with social and fiscal freedom on July 4, one day earlier than in 2019:

- The increase in purchasing power results from a temporary reduction in the VAT as part of economic measures to deal with effects of the Covid-19 pandemic. The standard VAT rate of 19% is lowered to 16% between July 1 and December 31, 2020.

- The VAT reduction represents a gain of €257 over the year, adding a day’s purchasing power, with social and fiscal freedom on July 4. Without this measure, the average German worker would have lost a day’s purchasing power compared to 2019, with social and fiscal freedom on July 6, 2020.

In six countries, more than half of work-related income is collected in taxes and charges: France, Austria, Belgium, Greece, Italy and Germany. Average workers have no direct control over more than 50% of the fruits of their labour, with their influence over decision-making being indirect at best.

On average, social and fiscal freedom day falls on July 14 in the European Union, one day later than in 2019:

- For the first time in six years, the effective tax rate on workers is rising. It is 45.09% in 2020, compared to 44.85% last year, an increase of 0.24%. In concrete terms, an average worker generating €100 in income before charges and taxes will pay €45.09 in compulsory deductions in 2020, leaving €54.91 at his or her disposal in real purchasing power. This is €0.26 less than in 2018 and €0.80 less than in 2010.

- Over one year, 13 EU countries have seen higher levies on the average worker, while the level is stable in one country and 13 have seen reductions.

FRENCH WORKERS REMAIN THE MOST HEAVILY TAXED IN THE EU, WITH SOCIAL CHARGES EXCEEDING REAL PURCHASING POWER

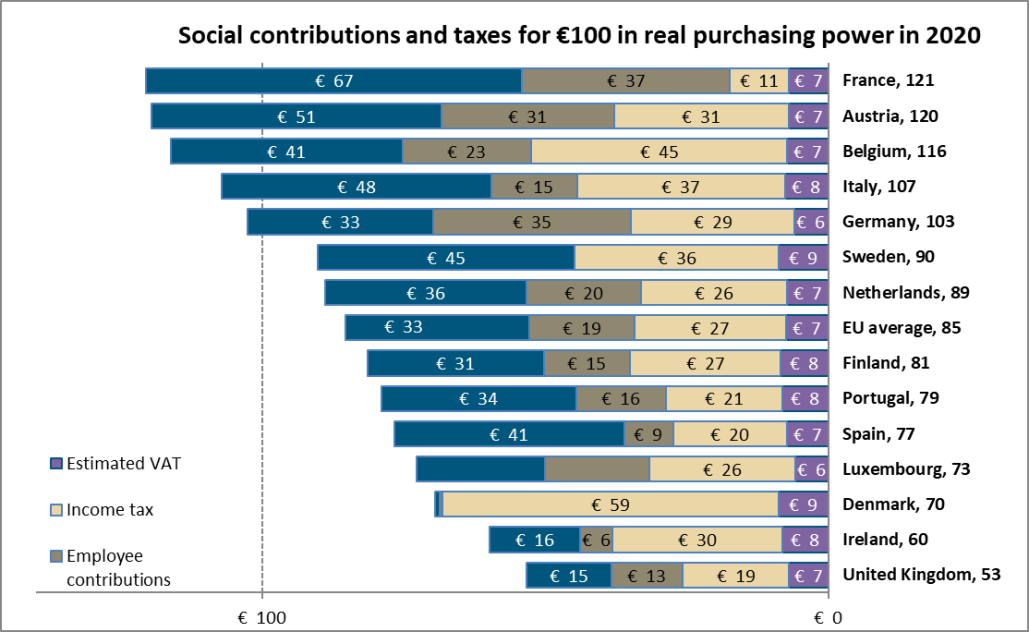

Before having €100 in real purchasing power at their disposal, average workers must pay €121 in charges and taxes in France, compared to €120 in Austria and €116 in Belgium. In comparison, the EU average is €85.

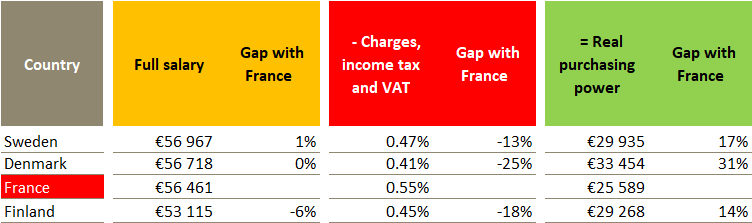

The average French worker is, in theory, among the best paid in the EU, at €56,461 (ranking eighth, between Denmark and Finland), but wages and salaries are so heavily taxed (54.68% in charges and taxes, ranking first in the EU) that only €25,589 in real purchasing power is left over (ranking 11th, between Belgium and Spain).

Despite being as well paid as a Swede or a Dane, the average French worker has 17% less real purchasing power than a Swede and 31% less than a Dane.

Though their employers face labour costs similar to those in the northern countries of the EU, average workers in France have purchasing power midway between levels in the northern and southern countries.

Social charges alone (€26,389, highest in the EU) amount to more than real purchasing power (€25,589, 11th highest). They equal 103% of real purchasing power, highest among the 27 EU countries, with a 51% average.

HIGHER CHARGES AND TAXES DO NOT GUARANTEE GREATER WELL-BEING OR BETTER PUBLIC SERVICES

The study shows that social and fiscal pressure in France is not synonymous with better living.

Quality of life seems better in various countries with less fiscal and social pressure: this is true of countries with a Bismarckian social tradition (Germany, Austria, Netherlands, Belgium), Beveridgian countries (Ireland) and all the northern countries (Sweden, Finland, Denmark).

Cross-referencing with work by the OECD (How’s Life?) shows that France, first in the EU in the real tax rate for the average worker, is only 10th out of the 20 EU countries covered in the Better Life study published by the OECD. Meanwhile, the World Happiness Report 2020 ranks France 12th out of the 27 EU countries.

These points suggest that social and fiscal pressure in France cannot be accounted for by a more attractive collective offering. French social and public benefits cannot be regarded as “low-cost”, as recent work by the Institut économique Molinari has shown.

Pensions, which account for 27% of public spending, are financed almost entirely on a current funding basis, with a lower return than in countries that augment contributions through savings. France misses out on about €60 billion a year in stock dividends, bond coupons and capital gains. This routinely impairs the quality/price ratio of French pensions, with a shortfall of €3,750 per retiree, or one-fifth of the pensions distributed.

Value for money is also average in education, which accounts for 10% of public spending. France’s position has deteriorated despite high collective investment. Even with France spending €155 billion a year, it ranks only 17th among 27 European countries. If France were to move closer to the countries that achieve the most efficient fit with the labour market, it could save up to €43 billion a year.

QUOTES

Nicolas Marques, general manager of the Institut économique Molinari, co-author

“Despite a change in rhetoric, French society remains heavily penalised by the scale of charges and taxes on labour.

“Over time, we have attained the top position in charges and taxes. The result is weaker growth in France than in the European Union as a whole. Unemployment remains abnormally high, with 500,000 too many people out of work compared to the EU average over the last two years. Our public deficits have fallen much more slowly than elsewhere, and debt has risen more quickly than among our neighbours.

“We saw a breakthrough in 2019 with a significant reduction in social charges. This, unfortunately, was nullified by an increase in the generalised social contribution.

“The year 2020 has been disappointing, with a very modest income tax cut. The first bracket has gone from 14% to 11%, but the threshold for entering the 30% bracket has been lowered, making the French reform less enticing. The gain amounts to €126 for an average unmarried worker. This is far less than the tax cuts in Austria, with €350 less in income tax, or in Germany, with €257 less in VAT as part of a plan to cope with the Covid-19 fallout.

“The challenge therefore continues to lie in reducing the levies that penalise workers directly as well as in lessening the tax measures that penalise them indirectly. Our outsized production taxes and our overly high corporate income tax lead to lower wages and to offshoring. These are societal errors.”

Cécile Philippe, president of the Institut économique Molinari and co-author

“For the fifth year in a row, France holds the top spot in compulsory levies on the average worker. We might have enjoyed having a high level of social and fiscal contributions, supposedly encouraging the development of public services and contingency schemes, but this isn’t what we’re seeing.

“Our pay-as-you-go pensions, which absorb 27% of public spending, are not as well managed as those of our neighbours, with lower reserves and higher deficits.

“Our health insurance spending, which accounts for 19% of public expenditures, is misallocated. Despite hefty health care spending, the French have had to endure rationing of protective masks and Covid-19 screening tests. In early July, we were doing only 300,000 tests a week, whereas the authorities had pledged to do 700,000 as the lockdown was lifted. This Malthusianism could turn, once again, against French society. This is incomprehensible, with experience showing that a national screening campaign costs far less than a broad lockdown.

“Our education spending accounts for 10% of public expenditures. This spending also suffers from poor value for money. We are seeing France’s position deteriorating, despite high collective investment. If France were to move closer to the countries that achieve an optimal fit between education spending and the labour market, it could save up to €43 billion a year.”

James Rogers, associate researcher at the Institut économique Molinari, co-author

“Despite the good news, French and Belgian wage earners are still devoting more than half of the amounts distributed by their employers to social contributions and taxes.

“It’s worth asking why they are not getting the top schools, the best health care and the most generous pensions in return and why they are not the leaders in indicators of human development or well-being.”

ABOUT THE AUTHORS AND THE METHOD

Tax and social charge Freedom Day is the date when the average employee stops, in theory, paying social charges and taxes and can use the fruit of her labour as she pleases.

This indicator measures the date starting on which the employee becomes free to apply the fruits of her labour in the way she wishes and not the date starting on which the employee may stop “working for society.”

The particularity of this indicator of economic freedom is that it puts the situation of average EU wage earners in tangible form by bringing together each country’s taxation of labour (social charges and income tax) and of consumption (VAT). Calculations of employer and employee social charges and of income taxes are done by EY for each of the 28 EU countries.

The study is written by Cécile Philippe, Nicolas Marques and James Rogers of the Institut économique Molinari (IEM).

The Institut économique Molinari (Paris and Brussels) is an independent research and education organisation. It seeks to stimulate the economic approach in the analysis of public policy, offering innovative alternative solutions that favour the prosperity of all individuals making up society.

THE STUDY IS AVAILABLE IN

- English at: https://www.institutmolinari.org/2020/07/18/the-tax-burden-of-typical-workers-in-the-eu-28-2020/

- French at: https://www.institutmolinari.org/2020/07/18/la-pression-sociale-et-fiscale-reelle-du-salarie-moyen-au-sein-de-lue-en-2020/

FOR INFORMATION OR INTERVIEWS, PLEASE CONTACT THE AUTHORS

- Cécile Philippe, president of the Institut économique Molinari (Paris, French or English), cecile@institutmolinari.org, +33 6 78 86 98 58

- Nicolas Marques, general manager of the Institut économique Molinari (Paris, French),

nicolas@institutmolinari.org, +33 6 64 94 80 61 - James Rogers, associate researcher at the Institut économique Molinari (Brussels, English),

james@institutmolinari.org, +32 497 946 840